BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

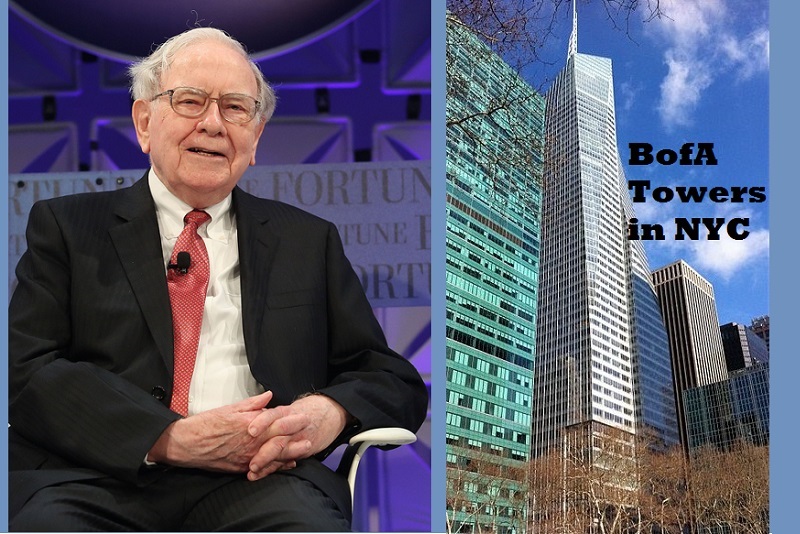

Warren Buffett’s BofA Deal Extends His Wall Street Empire

So, Warren Buffett’s Berkshire Hathaway is now the largest single shareholder of Bank of America. He recently converted his $5 billion holdings of BofA 6% preferred shares and warrants into 700 million shares of common stock. With BAC currently trading at $24.82 a share, Berkshire Hathaway’s holdings are now worth $17.34 billion.

Unrealized gains of $12.34 billion - not bad for a 6-year return on investment. And lest we forget that Berkshire Hathaway also took down $300 million each year in preferred share dividends.

BUFFETT’S SWEETHEART DEAL WITH BANK OF AMERICA. In August 2011 Buffett helped bail out Bank of America, whose shares had fallen 30% in the first 3 weeks of August over concerns the bank didn’t have enough capital. Berkshire Hathaway provided Bank of America with a $5 billion cash infusion, along with an implied imprimatur, or endorsement, from the most respected investor in America.

For his “troubles,” Buffett and Berkshire Hathaway received $5 billion worth of preferred shares that paid a 6% dividend. He also received warrants for 700 million shares of company stock - with an exercise price of $7.14, the price at which BAC shares then were trading. FYI - later that year, BAC’s market value dipped further as shares fell below $6. But of course, that was only temporary.

BERKSHIRE HATHAWAY’S OTHER WALL STREET HOLDINGS. Just so you don’t think that Warren Buffett is a one-trick pony - not that you would entertain such thoughts - it’s worth noting that Berkshire Hathaway has a well-diversified portfolio of Wall Street banks and financial institutions, that includes the following (as of 3/31/17):

- Wells Fargo – 480 million shares, or nearly 10% (biggest shareholder).

- US Bancorp – 85 million shares, or 5% (7th biggest shareholder).

- M&T Bank – over 5 million shares, or 3.5% (8th biggest shareholder).

- Goldman Sachs – nearly 11 million shares, or 2.8% (7th biggest shareholder).

- BNY Mellon – 33 million shares or 3.1% (8th biggest shareholder).

- American Express – over 151 million shares or 17%.

Source: New York Post (6/30/17), CNBC Portfolio Tracker.