BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

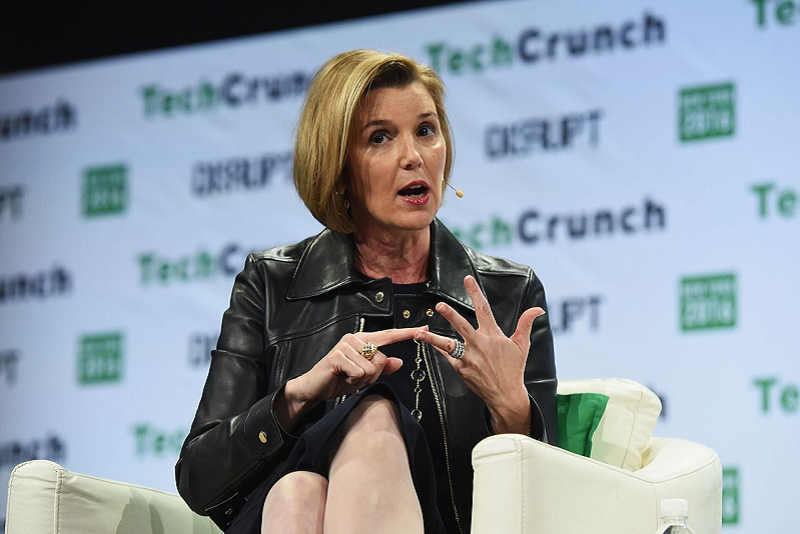

Sallie Krawcheck Reveals Personal Struggles with Love & Money

[Photo: TechCrunch Disrupt NY 2016 / Wikimedia Commons]

You're not alone: Even Wall Street titans have a hard time figuring out how to negotiate money issues in their relationships, as Sallie Krawcheck makes clear in a revealing interview with WNYC's Anna Sale on a recent episode of the podcast "Death, Sex & Money."

Years ago in her first marriage, Krawcheck - former CEO of Morgan Stanley's wealth management division Smith Barney, then CFO of Citibank - found herself making more than her husband. She was succeeding professionally while he was "plateauing." That was "part of what broke the marriage down."

After their divorce, Krawcheck had to learn how to handle her own finances for the first time, because, even though she had been making more, and even though she had been the one to go to business school, she had let her husband manage their money.

"I knew vaguely how much we had," Krawcheck says. "It's not that I didn't know. It's that I wasn't in control of it."

That, Krawcheck discovered, was a mistake. "When you're reeling from a break to a relationship, that's a really bad time to try to figure out how to manage your money," the CEO says.

When she married her second husband, she decided against signing a prenuptial agreement to protect her money. "We talked for a period of time about having a prenup, and made the decision not to," says Krawcheck. "It felt like we were negotiating a divorce before we got married." Remembering is enough to make her shudder.

Divorce isn't the only major financial setback Krawcheck has had to deal with. When the market crashed, her portfolio did too.

"My net worth was cut, certainly the majority of it was wiped out," she says. "Citi's stock went from $53 to less than $1. ... It was my largest asset. You can do the math."

And she hasn't been earning as much lately, because she's been busy starting her new investment platform for women, Ellevest.

Her second husband has been a very supportive partner, though, Krawcheck tells Sale. And this time around, she remains on top of her finances. Knowledge brings her comfort. "[I] keep an Excel spreadsheet on my computer where I keep track of what my net worth is, and that makes me feel better," she says.

Still, even for financial professionals, it turns out money is hard to discuss. "I don't like talking about money with you," Krawcheck blurts out. "This makes me very uncomfortable." Though she's made it her life's work to help other people talk about their financial situations, she tells Sale, "I never talk about my money!"

"It is interesting how awkward it is to talk about it," she says, "even though I talk about it in the abstract every day."