BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

Renaissance Technologies’ Medallion Fund Makes Too Much Money

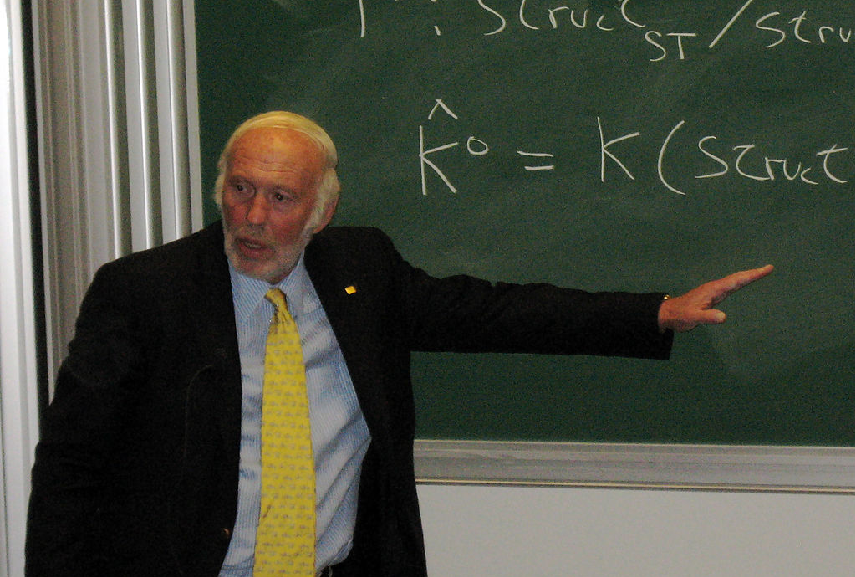

[Photo: Jim Simons, By Gert-Martin Greuel / Wikimedia Commons]

According to BloombergView columnist Matt Levine, the big problem with Renaissance Technologies, the quant investment manager founded by Jim Simons, is that its Medallion fund makes too much money:

Simons determined, almost from the beginning, that the fund’s overall size can affect performance: Too much money destroys returns. Renaissance currently caps Medallion’s assets between $9 billion and $10 billion, about twice what it was a decade ago. Profits get distributed every 6 months.

Medallion was up 21% for the half of 2016. It was up 35.6% last year, 39.2% the year before, 46.9% the year before that. Its last down year was 1989. Even in 2007, when the fund had a rough few days in August, it still ended the year up 85.9%.

It has returned about 40% per year, on average, net of fees, since it started in 1988. But it can't compound at that rate. It keeps handing money back to investors, because it has too much. If Renaissance had started 2007 with $5 billion, and had had the actual performance it has had over the last decade, but without returning money to investors, it would have $214 billion now. That's too big. In actual fact, it keeps handing back the money, and "has produced about $55 billion in profit over the last 28 years."

Renaissance co-head Peter Brown says that his firm seeks out signals – lots and lots of signals. And not the ones that make a lot of sense and are very strong, because they would have been traded out long ago. No, instead:

“What we do is look for lots and lots, and we have, I don’t know, like 90 Ph.D.s in math and physics, who just sit there looking for these signals all day long. We have 10,000 processors in there that are constantly grinding away looking for signals.”

What they want are signals that don't make much sense, that aren't very strong, that you can't grasp intuitively and then go out and implement. They want stuff that looks like noise, but that in the hands of a powerful enough computer with cheap enough implementation costs, can make a little bit of money. Over and over again.

And so Renaissance doesn't really hire people because they understand investing. "A résumé with Wall Street experience or even a finance background was a firm pass" early on at Renaissance, and it's full mostly of speech-recognition specialists and astrophysicists and string theorists, scientists who "excel at screening 'noisy' data." It's a pattern-recognition firm, a data-processing firm, a firm for finding correlations and signals and using those signals to make frequent, tentative, marginally profitable decisions. Which add up to 40 percent annual returns, year after year.