BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

PricewaterhouseCoopers vs. Jon Corzine – Who’s Truthful? Who’s Right?

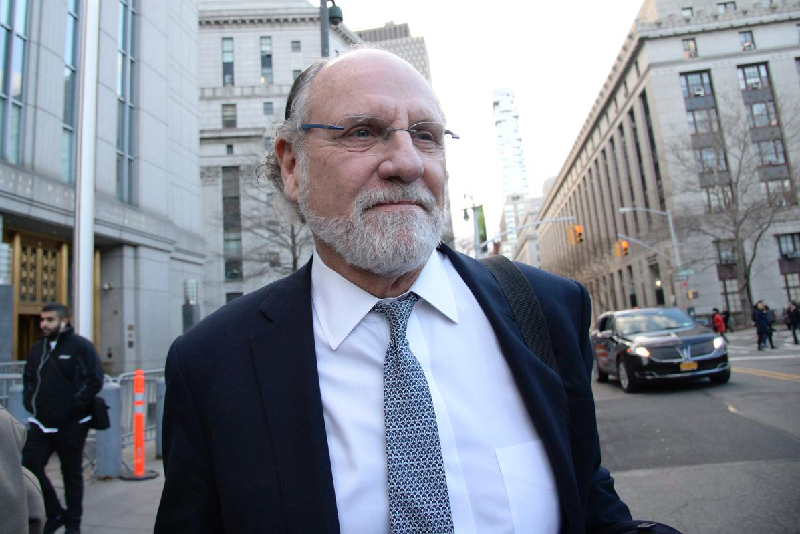

[Photo: by Jefferson Siegel / NY Daily News]

The malpractice case against PricewaterhouseCoopers, or PwC, has completed 2 days of testimony. Jon Corzine, the former Chairman and CEO of MF Global, has been under heavy cross-examination from James Cusick, the lawyer representing PwC.

Corzine never wavered from his assertion that the collapse of MF Global, which happened under his stewardship, had nothing to do with the financial health of MF Global. Corzine professed that he had not been overly worried about the firm’s credit rating, even as Mr. Cusick rattled off some 99 financial issues that Moody’s factored into its downgrade of MF Global.

While Corzine never blamed PwC directly, he testified that he and his team relied “on the advice they were receiving and I was receiving, from our outside public accountants.” Corzine did specifically note that PwC's decision to change its advice on accounting for "deferred tax assets," and MF Global's decision to reveal more than PwC had required about the European debt to calm jittery markets, prompted "confusion" and a "loss of confidence and trust."

That Euro debt would refer principally to Corzine's $6.3 billion bet on sovereign debt from 5 European countries, which spooked nervous markets after a recent near-shutdown of the U.S. government.

So, while we wait for testimony to play out in this Manhattan federal courtroom, we look for any indications of definitive proof that establishes PwC’s advisory role as having played a significant and integral role in the timing of the financial troubles that ultimately upended MF Global.

It will be interesting to see if, during the course of this 5-week trial, testimony comes out about other aspects of MF Global’s 2011-2012 melodrama:

- e.g., MF Global’s misuse of $1 billion of customer funds that should have been securely segregated, but which the firm used as collateral for its undermargined positions.