BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

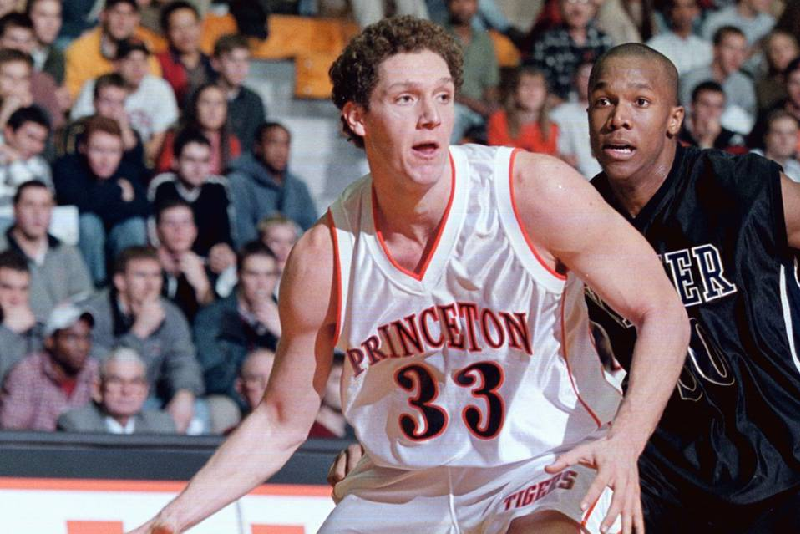

Nate Walton: Born to Play Basketball, But Winning at Private Equity

[Photo: Nate Walton, by Beverly Schaefer / Princeton University]

Nate Walton, the 6-foot 7-inch son of basketball great Bill Walton and older brother of L.A. Lakers coach Luke Walton, was born to star on the hardwood. Instead, the former Princeton basketball captain is winning in high finance.

A partner in the private-equity group at Ares Management, Mr. Walton orchestrated one of the most successful shale deals in recent years, expected to net more than a $1 billion within a year.

Ares’s shares jumped 11% - the stock’s 2nd biggest one-day gain ever - after The WSJournal in January reported its expected profits from the sale of Texas oil producer Clayton Williams Energy, in which Mr. Walton had led Ares to invest during the depths of the recent oil-price slump. The sale of Clayton Williams was part of a run that has lifted Ares shares 80% over the last year. That is tops among its rivals, including Blackstone Group and KKR.

Nate Walton said Ares’s flexibility to buy corporate debt, equity or sometimes both has enabled the firm to tailor deals to entice energy executives into partnerships and boost returns. At a time when many financiers have aimed to acquire drilling fields on the cheap from beleaguered oil producers, Ares opted to invest directly in such companies.

NATE WALTON’S PERSONAL BACKGROUND. Nathan Whitecloud Walton was born in 1978, the year after his 6-foot-11-inch (7’3”?) father led the Portland Trail Blazers to their only NBA championship. The 2nd of four boys who grew up mostly in Southern California, Nate was the most scholarly of the bunch. As a 6-year-old, his mother recalls, he begged for a computer years before many people knew what a PC was.

“He was the smartest of all the brothers, by far,” said Luke Walton, who won two championships with the Lakers before becoming the team’s coach this season. “We had classes together. I’d get a B- and he’d get like a 98%.”

Nate’s parents, who are divorced, said their son soaked up the experiences afforded to the child of a star athlete. There were driveway shoot-arounds with basketball legend Larry Bird and banter with best-selling author David Halberstam over dinner.

Susie Walton, his mother, recalled a teenage Nate hitting it off with his father’s friend Timothy Leary and asking if the psychologist known for advocating psychedelic-drug use could become his godfather.

Nate Walton was wooed by big-time basketball programs but opted instead for the Ivy League. At Princeton, Mr. Walton was an under-sized center and team captain his senior year. The team’s famed offense of constant motion and back-door cuts flowed through him.

He had brief spell at a hedge fund in New York, where he lived with his college buddy, Brett Icahn, son of billionaire investor Carl Icahn, and another with the Boston Celtics front office.

He returned to California and on a lark ran for governor in 2003 to replace Gov. Gray Davis, who had been recalled. Campaigning in the family uniform of tie-dyed T-shirt, Mr. Walton finished 47th out of about 135 candidates, well behind the winner, Arnold Schwarzenegger.

Mr. Walton enrolled at the Stanford Graduate School of Business that year and joined Ares in 2006 on the credit desk. He was soon noticed by two of the firm’s founders, Bennett Rosenthal and David Kaplan, who moved him to the private-equity team and assigned him to the oil-and-gas sector. Over two years, his group studied some 200 oil companies for investment opportunities. Ares made only one investment in a closely held Texas oil company, though.