BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

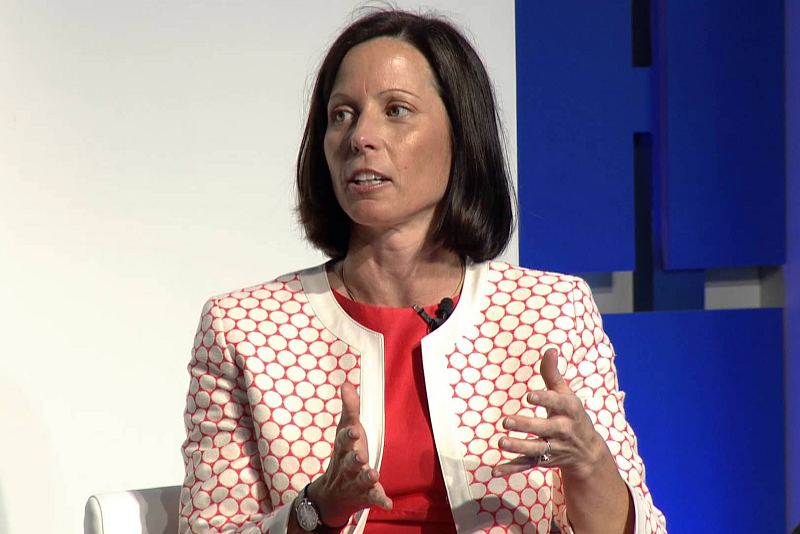

Nasdaq’s New CEO Adena Friedman Has Big Job: Reimagining the Stock Exchange

[Photo: YouTube Screengrab]

Adena Friedman recently succeeded Robert Greifeld as CEO of Nasdaq Inc. – a tough act to follow. During his 14-year tenure as CEO, Greifeld, now chairman, fought to keep Nasdaq a formidable competitor of NYSE and spearheaded a multibillion-dollar deal to take over Nordic stock-market operator OMX AB in 2008. Nasdaq’s revenues reached $3.7 billion last year, compared with $590 million in 2003, the year Mr. Greifeld became CEO.

Greifeld succeeded even as regulations in the late 1990s and 2000s brought competition to exchanges. For example, it opened the door to high-tech upstarts like BATS Global Markets, which surpassed Nasdaq Inc. as the 2nd-biggest U.S. exchange group by volume in 2014, and dozens of dark pools.

More recently, Nasdaq has seen its share of U.S. equities volume slide due, in part, to a broad shift in trading toward securities listed on the NYSE and its sister exchanges, including NYSE Arca, which specializes in ETFs. Earlier this week, Snap Inc., owner of the popular messaging app Snapchat, opted to list its new shares on the NYSE – following its March 2017 IPO.

To keep Nasdaq growing, Ms. Friedman plans to keep pursuing a strategy, initiated under her predecessor Robert Greifeld, of diversifying away from the stocks business into financial technology. And that makes sense, given Ms. Friedman highly-regarded reputation for being young, tech-savvy and the first woman to lead a major U.S. stock-exchange operator.

Ms. Friedman is perhaps most excited about the potential of artificial intelligence. Nasdaq uses AI in systems designed to spot wrongdoing at banks and tools that seek to enhance hedge funds’ stock-trading strategies. Such efforts account for a tiny slice of Nasdaq’s sales today, but Ms. Friedman sees huge potential in AI.

“We think in the next decade it could really transform the business.” - - Ms. Friedman.

ADENA FRIEDMAN’S CV. Ms. Friedman, 47, joined Nasdaq after finishing business school at Vanderbilt University. From 1993 to 2011, she held job titles including head of data products, head of strategy and chief financial officer, and sometimes played second base on a company softball team.

She was a key player in the 2005 acquisition of Instinet Group Inc.’s computerized trading division, a deal aimed at shoring up Nasdaq’s trading technology. While Mr. Greifeld shaped the vision for the deal, Ms. Friedman was one of his top lieutenants in implementing it and worked many late nights to make it happen.

In 2011, Ms. Friedman left Nasdaq to become CFO of PE powerhouse Carlyle Group. She said she left because Carlyle offered her an “amazing opportunity” and she wanted to spend more time with her husband and two sons in Washington, D.C., where the buyout firm is based. However, after 3 years at Carlyle, Ms. Friedman returned to Nasdaq as president in 2014.

Analysts say Ms. Friedman is well positioned to oversee Nasdaq’s tech-centric strategy going forward, citing her previous leadership of the firm’s data and technology businesses.

Ms. Friedman is betting that the tech focus will pay off. “We are more than an exchange company today,” she said.