BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

Morgan Stanley’s Hottest Young Trader Has Moved on to Fintech

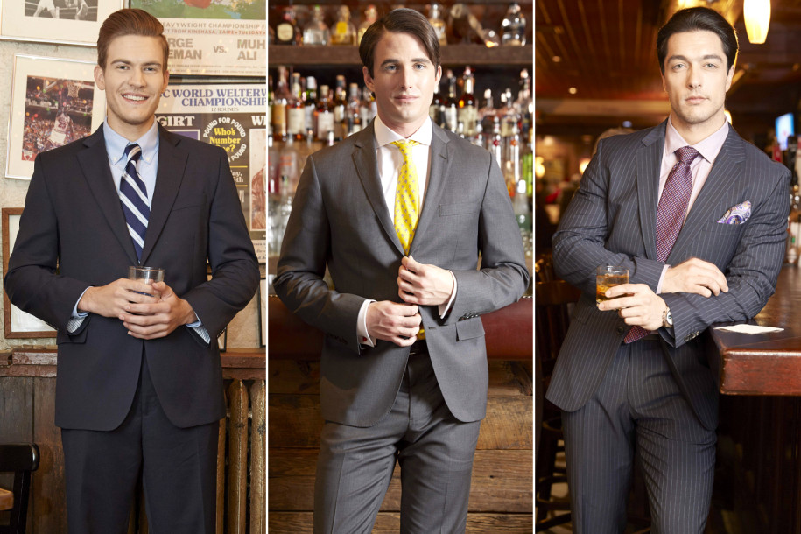

[Photo: Young Bankers, by Rene Cervantes / NYPost]

In the world of ‘juniorization’ of the trading floor, it’s the under-30s in investment banks who hold all the power. But what if, despite all the rapid promotions and increased responsibility, they decide to leave anyway?

That’s the case with Jonathan Birnbaum at Morgan Stanley. Birnbaum was named last year to Forbes’ 30 under 30 in finance. At 29, he was COO of its U.S. credit trading group, leading a team of 100 people across investment grade, high yield and distressed debt trading, despite only holding a VP level position.

Birnbaum has just started a new real estate focused fintech firm called Vistia, which allows homeowners to access future equity in their property today by receiving cash in exchange for sharing any future appreciation in its value. He teamed up with Steven Coulis, who was formerly an emerging markets trader at Pharo Management.

Birnhaum was the epitome of the tech-savvy traders that investment banks are trying to keep hold of. He not only worked as an emerging markets fixed income trader, but also grew the banks’ electronic trading business by working on IT projects to improve its platform and workflow.

When he moved across to his COO role, he led a project to use flow data to algorithmically match bond sellers and buyers in real-time. A degree in computer science from MIT – in addition to a management degree with a finance focus – will have almost certainly have given him an edge over less tech-savvy traders.

However, last year he also completed an MBA from Columbia Business School, which involved Friday and Saturday study. This clearly gave him the necessary skills to launch his own business.

Birnhaum was named by Forbes alongside some other fast-tracked young traders like Darren Dixon, the 29-year-old Goldman Sachs managing director who focused on Latin America credit trading. Other Goldman traders to move up the ranks quickly include Dan Avery, a 28-year-old index trader and Sam Berberian, a high yield credit trader, both of whom were promoted to managing director last year.

Goldman Sachs is promoting more Millennials up the ranks faster than ever. In a recent LinkedIn post, its global head of human capital, Edith Cooper, said “our workforce is nearly 70% millennial - even our latest partner class is composed of 11% millennials, and of course, that number will only increase as the years go by.” In other words, it probably helps to have an exit plan even if you’re a hot young thing.