BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

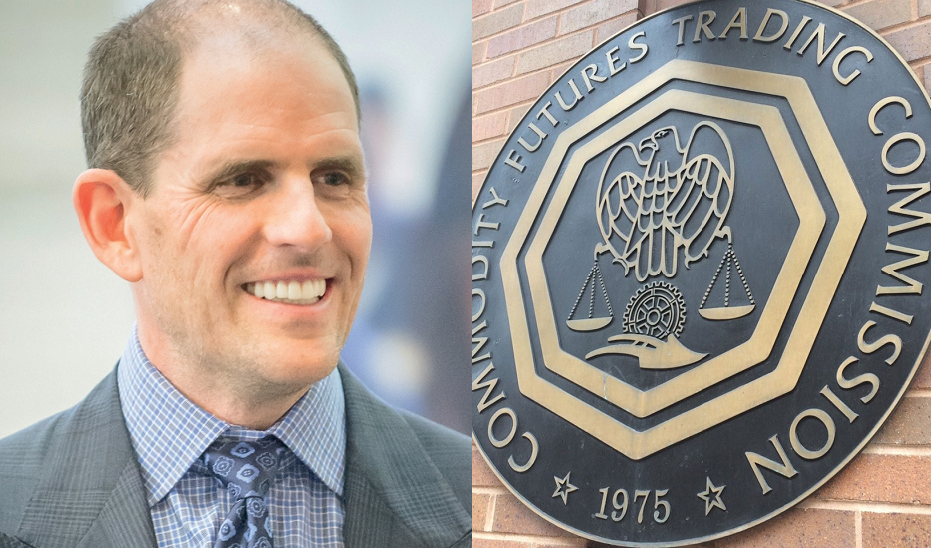

Market Manipulation Judge to CFTC: ‘Illegitimacy’ Is Not ‘Artificiality’

The lawyers in the market-manipulation trial of futures trader Donald Wilson Jr. and DRW Investments gave their closing arguments on Wednesday. Only problem was that U.S. District Judge Richard Sullivan repeatedly interrupted the lawyers for the CFTC as they gave their closing arguments, suggesting they had failed to prove a crucial point.

Mr. Wilson and his firm, DRW Investments LLC, are charged with having manipulated an interest-rate contract in 2011 to yield $13 million in profits.

Judge Sullivan questioned whether the agency had successfully proven that DRW’s actions had created an artificial price for the contract, which the CFTC must do to win its case.

“There are multiple elements to market manipulation and it’s not clear to me that you’ve proven a central one, which is artificiality,” Judge Sullivan said in a Manhattan courtroom.

Earlier in the trial, Judge Sullivan grilled Mr. Wilson over evidence in the case, including an email in which a DRW trader described companies that took the opposite side of the firm’s trade as “suckers”.

But on Wednesday the judge’s toughest questions were aimed at the CFTC. He admonished the agency’s lawyers for focusing on what they described as “illegitimate” bids and sidestepping the issue of whether DRW had caused an artificial price.

“You keep using ‘illegitimacy’, which is a very fuzzy term, to somehow be the equivalent of artificiality,” Judge Sullivan said. Arguing that DRW’s bids created an artificial price because they were made with an illicit intent was “so circular as to be nonsensical,” he added.

Background Information. The CFTC’s allegations against DRW stem from a big trade in interest-rate swap futures that the firm carried out in 2010 and 2011 on an exchange owned by Nasdaq Inc. The contracts allow companies to bet on or protect against swings in rates.DRW bought more than $350 million of the futures in late 2010, expecting the position to rise in value, the CFTC said in its lawsuit. In January 2011, the firm began placing bids in a 15-minute afternoon settlement window used by the exchange to determine the contract’s closing value at the end of the day. The CFTC argues that those bids, which continued through August 2011, were an illegal strategy called “banging the close” that was aimed at enhancing the value of DRW’s large position in the futures contract.