BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

In Judgment of the Barclays CEO Who Tried to Unmask a Whistleblower

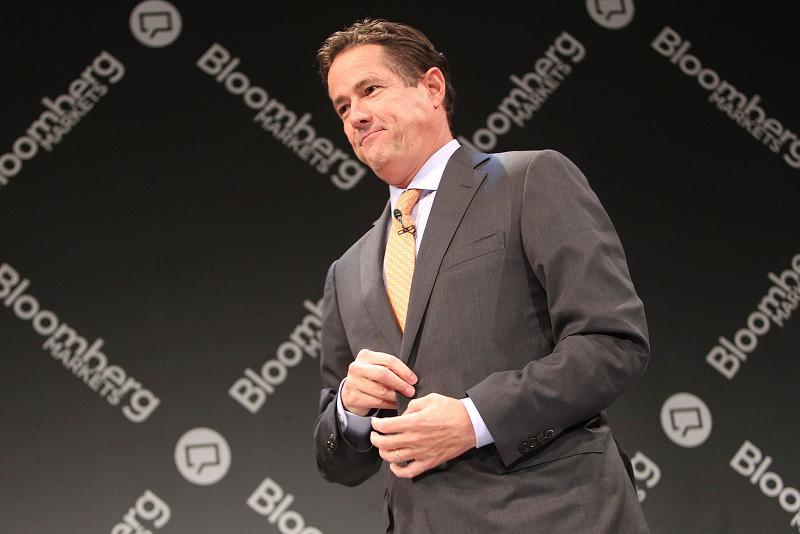

[Photo: Jes Staley, by Bloomberg News]

So, a CEO of a major global bank offers contrition for seeking to out a whistleblower. That, of course, would be Jes Staley of Barclays. His actions, which took place last June, and those of his firm are under investigation by several regulators - the U.K.'s Financial Conduct Authority, Bank of England's Prudential Regulation Authority, and New York State's Department of Financial Services. The investigations can lead to fines and even suspensions or bans for those who are found to have violated the laws.

IN THE NEWS. The upcoming Barclays annual meeting – to be held on May 10 – is the only real reason that this issue is in today’s headlines. Yes, on that date, Barclays shareholders will vote on whether to retain or re-elect Mr. Staley as Chief Executive.

The ‘jury’s’ still out on his future, though it looks as the Mr. Staley will be staying on board- at least for another year. Most importantly, Mr. Staley has the unanimous backing of the bank’s board of directors. And, while the proxy advisory firm, ISS is supposedly wavering on its support of Mr. Staley, governance advisers Glass Lewis and PIRC both recommend his re-election.

APPROPRIATE ACTIONS. That said, the bank must decide on an appropriate punishment for Mr. Staley. Barclays directors are already planning to significantly reduce (eliminate?) Mr. Staley’s performance bonus. That would be a starting point, but does it really “send a meaningful message.” Perhaps the best way to determine what’s meaningful, is to consider what Mr. Staley did and how his actions impacted the bank.

Here’s our crack at it:

- Mr. Staley violated laws.

- Mr. Staley violated firm policy.

- Mr. Staley has weakened the firm’s whistleblower protection program because Barclays employees are now weary that they and their jobs will be protected if, and when, they seek to report a perceived wrongdoing in the firm.

- Mr. Staley abused the power of Chief Executive by demonstrating his belief that ‘might makes right’ - i.e., as CEO, his actions should be unemcumbered by others’ judgement or oversight.

- Mr. Staley damaged his credibility by choosing to act unilaterally – i.e., without first seeking proper counseling.

- Mr. Staley showed weakness as a CEO by allowing his actions to be driven by personally motives, rather than objective reasoning.

- Mr. Staley established himself as one who personally cannot be trusted, particularly with confidential information.

Given the above ‘laundry’ list, the argument for retaining Mr. Staley would be questionable, at best. Of course, we are outsiders and are simply expressing our perceptions. Mr. Staley appears to have been an able steward of the bank’s recovery plan, and that, to some extent, should matter. For example, the bank just reported a doubling of its Q1 pre-tax profits.

What are your thoughts?

[For insights into Mr. Staley’s background, click on … Who Is Jes Staley?]