BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

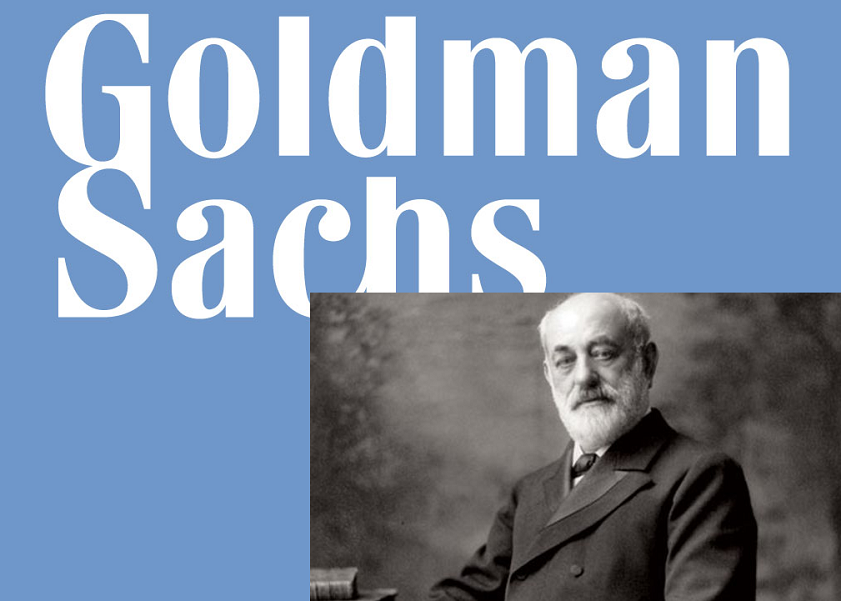

Goldman Rolls Out 'Marcus' Ads to Consumers

[Photo of Marcus Goldman: Haaretz.com]

BloombergView columnist Matt Levine offered his take on Goldman’s new advertising campaign.

Hey America: Did your dog chew up your sofa? Did a baseball hit your windshield while you were watching a Little League game? Are you mired in unsustainable credit-card debt as a result of the relentless societal pressure to maintain a lifestyle of showy consumerist consumption in the face of stagnant real wages and deep insecurity about the future? Do you know who can help? You will not guess. I mean, Money Stuff readers will guess. But most of America has no idea what's coming for them.

That's right, Goldman Sachs Group Inc. is rolling out consumer ads! They "will appear on Facebook, Hulu, Pandora and YouTube," and they "depict debt as an unavoidable nuisance of modern life, not shameful overspending on unaffordable luxuries." A "head of brand management" is involved:

Dustin Cohn, the head of brand management for Goldman’s new consumer lending arm, Marcus by Goldman Sachs, said the bank’s aim was to “destigmatize debt and help consumers explore new ways of managing their debt.”

The ads are ... fine? Like, they would make me want to run out and get a Goldman Sachs loan to consolidate my high-interest credit-card debt, if I had credit-card debt. My favorite is the one about how Goldman's consumer lending product, unlike credit cards, has no embedded optionality for Goldman: The interest rate is fixed for the life of the loan, and won't go up for late payments or credit-score changes. Goldman's branding push, in its move into consumer banking, is simplicity. Goldman! Its advantage in most of its activities comes from smarts and structure, from mastering complexities that others shy away from. Here it went the other way. I like to imagine that Goldman got a bunch of credit-derivative structurers in a room and asked them to figure out consumer lending, and they looked at some credit-card agreements and were like "holy cow this is too complicated." So they thought real hard about it and were like "what about a fixed-rate no-fee loan where we just make money by charging interest?"

It's lovely, more power to them. Remember the last financial crisis, when Goldman executives were hauled before Congress and asked about their subprime lending practices? And they looked bewildered and said, you know we don't actually lend to consumers, right? Next time they won't have that excuse!