BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

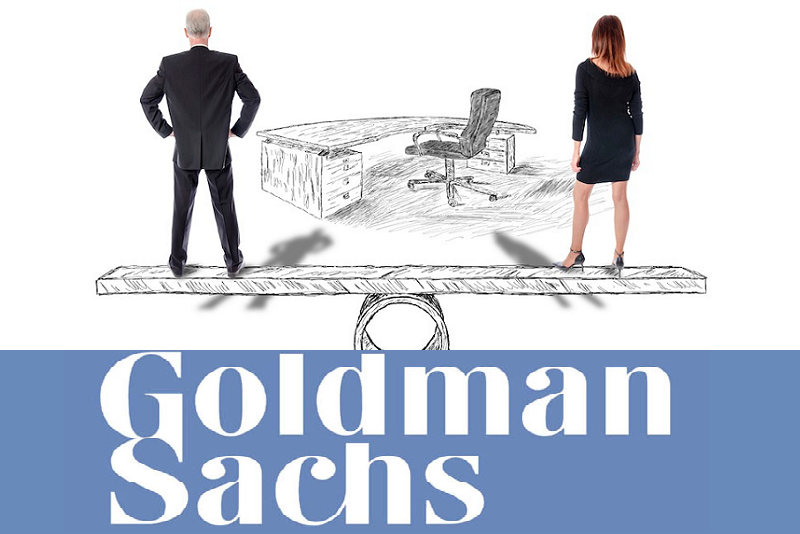

Goldman Gender Bias Lawsuit – Going On 7 Years

Chen-Oster et al. vs. Goldman Sachs & Co. et al., was filed in U.S. District Court, Southern District of New York, in September 2010. In the lawsuit, brought by Lisa Parisi, Cristina Chen-Oster and Shanna Orlich, Wall Street's most profitable bank is accused of maintaining an "outdated corporate culture" that systematically deprives women of pay and promotions available to men. At the time of the filing, the plaintiffs sought class action status on behalf of women who have worked as Goldman managing directors, vice presidents and associates in the last 6 years (i.e., prior to 2010). Since 2010, Lisa Parisi agreed to arbitration, and 2 new plaintiffs - Allison Gamba and Mary De Luis - joined the lawsuit.

WHY IT'S IN THE NEWS TODAY. The lawsuit is back in the news because a federal judge rejected Goldman’s bid to dismiss 2 of the 4 female plaintiffs in this proposed class-action lawsuit. promotions. Judge Analisa Torres said former VP Mary De Luis' claims did not become moot when she resigned last May, after the bank allegedly retaliated for her role in the case by refusing to allow a transfer to Miami from Dallas unless she accepted a demotion. And former VP Allison Gamba had standing to pursue her claims even after Goldman left her without a job in August 2014 when it "divested itself" of her department.

That said, it remains to be seen how long it will take to get a final ruling on the case's bid to be a class-action lawsuit.

PLAINTIFFS.

CRISTINA CHEN-OSTER, 46, Former VP in Convertible Bonds. Ms. Chen-Oster, who resigned from Goldman after 8 years in 2005, alleged that she was repeatedly shunted to lower-paying and lower-priority jobs, and had her accounts taken away after she returned from a maternity leave. She also said that after a dinner at a topless bar to celebrate a colleague's promotion - an event that all employees in her group were encouraged to attend - a male colleague attempted a sexual act with her. She further contended that she was subjected to a sexually charged e-mail by a male colleague that made fun of her Chinese heritage.

SHANNA ORLICH, 37, Former Associate in Trading. Ms. Orlich, whose job was terminated in 2008 after having worked at Goldman since 2006, contended that she was deprived of work and subjected to greater criticism than male workers. She said that she was not invited to golf outings because of her gender – though the excuse was that she was too "junior," even though several male colleagues just out of college attended. She also said that a trader with less experience than her was given a trading seat "right away," and that their bosses used to challenge him to push-up contests.

LISA PARISI, 48, Former Managing Director in Asset Management. Ms. Parisi, whose job was terminated in 2008 after having worked at Goldman since 2001, alleged that she was significantly underpaid compared with male colleagues, including a 60% drop from 2005 to 2007, and had investments taken away from her despite her skill in stock picking.

MARY DE LUIS, Former VP in Investment Management. Ms. De Luis, who spent 6 years at Goldman, claimed that Goldman had forced her to quit based on a lack of equal pay and promotion opportunities, as well as rescission of a previously agreed-upon transfer. Ms. De Luis said that Goldman knew since 2012 that she’d need to move to Miami for family reasons in 2016, but retaliated against her for joining the lawsuit by refusing to create a position for her in its Miami office.

ALLISON GAMBA, Former VP in Securities Division. Ms. Gamba, a 13-year veteran trader at Goldman, said that Goldman had discriminated against her in the way it evaluated her performance and had paid her less than similarly-situated men. She also said that she was "passed over" for a promotion from VP to MD in 2008 due to her gender. That position went to a less-qualified male.