BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

Goldman Carving Out Nice Online Bank Niche

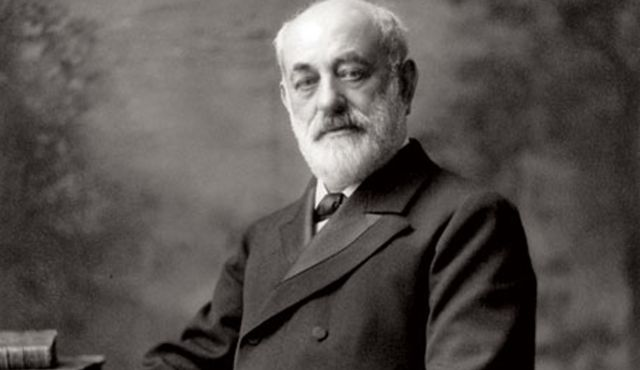

[Photo: Marcus Goldman / Haaretz.com]

Consumer lending is a big market, with about $1 trillion in consumer loans in the U.S. alone. Credit cards finance have most of that debt, while fintech firms are making inroads by offering online loans with cheaper rates.

And then there’s Goldman Sachs, with Marcus, its consumer lending arm. Since inception, Marcus bank has lent out about $1 billion in consumer loans. In 2017, Goldman expects that figure to double. And it’s doing so with consumer loans ranging from $3,500 to $30,000. That’s a relatively slow pace for Goldman, which deals each day in multi-billion financial transactions. But that’s okay with CEO Lloyd Blankfein’s expectations, who told Mad Money’s Jim Cramer that the firm wants to make sure it’s doing a good job. [And he might well have said, "You don’t have to be the first, just the best."]

Meanwhile, troubles appear to be sprouting at Goldman’s online competitors.

- Loans are going bad faster than expected – which shouldn’t be a surprise. Alarm bells are going off on Wall Street and among regulators over concerns that borrowers may be overburdened. [See Financialish story, “JPMorgan, Wells Fargo Are Selling Subprime Asset-Backed Securities - Should You Be A Buyer?”] Goldman has the technology expertise to develop and apply algorithms for closely monitoring its borrowers.

- Borrowing costs have increased. That’s an issue that probably won’t impact Goldman, where depositors have been lining up for savings accounts at Marcus – which offers relatively high savings account rates.

- One competitor, Promise Financial, has even stopped making new loans and is instead licensing technology to banks.

And if you listen closely, you may even be able to hear Lloyd Blankfein humming the song lyrics from the 1946 Broadway musical, “Annie Get Your Gun” - “Anything you can do, I can do better.”