BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

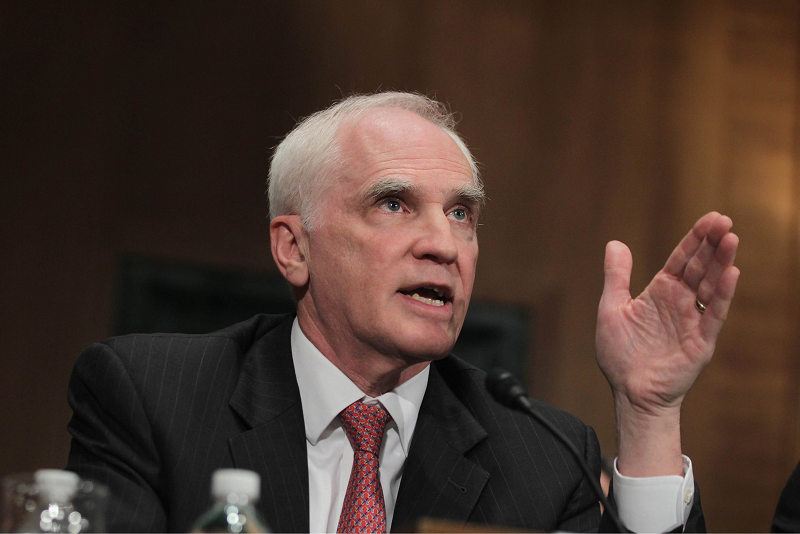

Daniel Tarullo, Fed's "Regulatory Point Man", Unexpectedly Resigns

On Friday, Daniel Tarullo, the central bank's top financial regulator, submitted his resignation, effective April 5. His term doesn’t expire until 2022. In his brief departure letter, Tarullo just said 2 sentences:

"After more than eight years as a member of the Board of Governors of the Federal Reserve System, I intend to resign my position on or around April 5, 2017. It has been a great privilege to work with former Chairman Bemanke and Chair Yellen during such a challenging period for the nation's economy and financial system."

Here are some of the comments from ZeroHedge on this sudden and unexpected announcement:

Last October, as part of the Podesta email leaks, we [ZeroHedge] disclosed the particularly close relationship between Fed governor Dan Tarullo and Barack Obama, which emerged as part of a previously undisclosed memo involving the AIG bailout. We speculated that as a result of this now public disclosure it was possible that Tarullo's days at the Fed were numbered should Donald Trump win the election. Trump won, and moments ago Dan Tarullo unexpectedly announced that he is resigning in early April, just days after the Fed's general counsel Alvarez also announced that he is departing the Fed.

What makes Tarullo's resignation particularly notable is that Tarullo has been the Fed's "regulatory point man" since 2009, suggesting some regulatory friction has emerged. He did so, in part, by effectively filling the role of Federal Reserve Vice Chairman, a position that has remained vacant for years. Tarullo did so even without that title.

Yet, given Trump's vow to crush Wall Street regulations, and the expectation that he will appoint someone else to the currently vacant post of Federal Reserve vice chairman in charge of bank oversight – someone who likely would challenge Mr. Tarullo’s influence - one can see why Tarullo thought his services are no longer necessary.

Tarullo, 64, was appointed to the Board by President Obama for an unexpired term ending January 31, 2022. During his time on the Board, he served as Chairman of the Board's Committee on Supervision and Regulation. He was also Chairman of the Financial Stability Board's Standing Committee on Supervisory and Regulatory Cooperation. Mr. Tarullo also had effectively filled the role of Federal Reserve Vice Chairman, even without that title.