BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

Carlyle Aims to Raise Another $100Bn - Yes, $100 Billion!

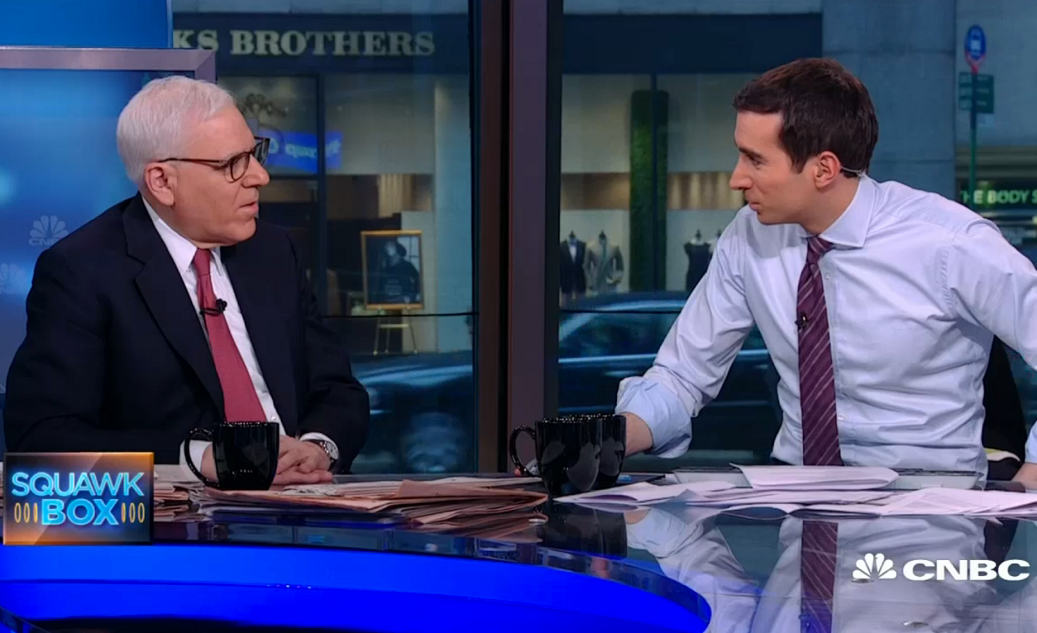

[Photo: David Rubinstein interviewed on CNBC's Squawk Box / NYTimes]

Faced with richly valued stocks and bonds, investors are turning to private-equity firms for higher returns.

Carlyle Group said it expects to raise $100 billion for its funds in the next several years from investors seeking higher returns in an era of ultralow interest rates and richly valued stocks and bonds. The Washington, DC, PE firm currently manages around $169Bn, up from $107Bn at the end of 2010. David Rubenstein, who founded the firm in 1987 with William Conway and Daniel D’Aniello, called the fundraising goal “substantial but quite realistic.”

It is not clear where all the money flowing into private equity will go. U.S. PE funds were already sitting on an all-time high of $474 billion of investor commitments, or “dry powder,” at the end of 2015. And, keep in mind that Carlyle has invested (just) $12.5Bn in the past 12 months, and has $54.4 billion in dry powder.

Private-equity firms like Carlyle buy companies and fix them up with the intention to sell them later for a profit. The firms also buy real estate, make loans and invest in infrastructure and corporate debt, among other activities.

Yet, despite such high cash piles, investors continue to pour money into funds, lured by the promise of higher returns. Carlyle said it is likely to start raising money for new buyout funds targeting the U.S., Europe, Asia broadly and Japan specifically by the end of 2017. It expects funds targeting energy and real estate to add to the haul.