BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

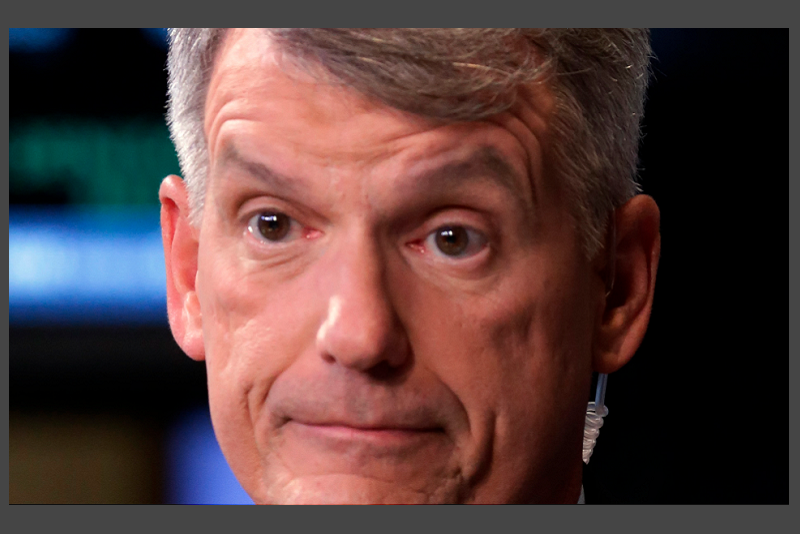

Wells Fargo Now Admits it Retaliated Against Workers

Wells Fargo reports that it has found evidence that the bank retaliated against workers who raised questions about aggressive sales tactics and illegal account openings that lead to its ongoing fake accounts scandal.

"Wells Fargo CEO Tim Sloan said last week in a town hall meeting that the bank has reviewed all reports made by its employees to the confidential ethics line over the past 5 years where the callers identified themselves. That was roughly 40% of callers to the hotline," CNN Money reports."Wells Fargo hired an unnamed 3rd party to look into cases where employees were terminated within 12 months of calling the ethics line."

"A few cases out of the hundreds reviewed raised questions, and we are following up on each of them," Sloan said in a companywide address last week. [Bold emphasis provided by financialish.com]

When asked by CNN if that statement meant the bank had found retaliation had happened, a spokesperson for the bank said, "Yes, that is how I would read it. Where we have cause for concern, we're going to keep looking further."

“This group will be tasked with ensuring a consistent process for identifying, assessing, investigating, correcting and reporting on practices that do not align with our expectations for high ethical standards and excellence in risk management,” Sloan said during that same address. Any action to identify, assess, investigate, correct and report on retaliatory practices may have come too late for some current and former employees of the bank, however.

CNN reports that dozens of workers who were penalized or terminated for speaking out about the aggressive and illegal sales tactics contacted the news agency to detail how the bank had retaliated against them. Bill Bado, a former Wells Fargo banker in Pennsylvania, recounted his call to the ethics hotline about being instructed to open phony bank and credit accounts. Bado even provided a September 2013 email to HR flagging these concerns. Eight days after sending the email, Bado was terminated - for tardiness," CNN reports.

- "The firing also put a stain on Bado's securities license, and he found he couldn't get hired in the industry. Bado's financial troubles worsened after that. His house was on the verge of being foreclosed on and he worked part-time at the grocery store chain Shop-Rite."

- "They ruined my life," Bado told CNNMoney.