BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

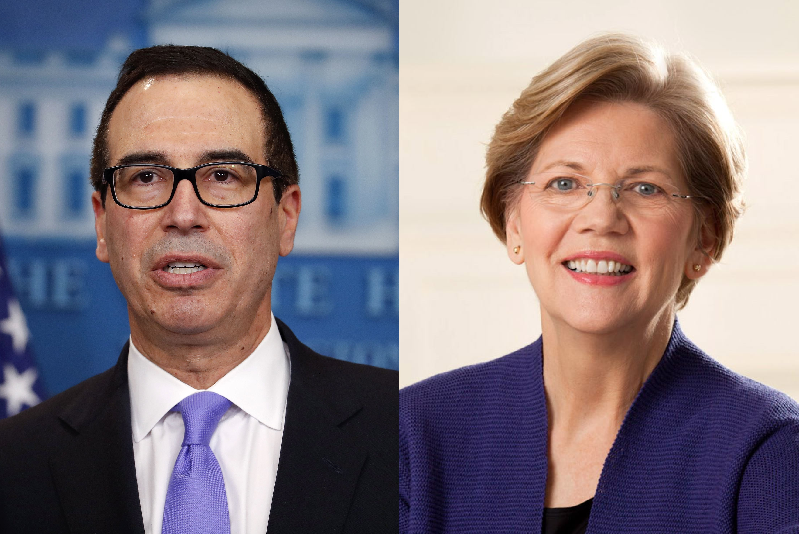

Warren v. Mnuchin - Obfuscation At The Highest Level

Elizabeth Warren: You said we need a 21st-century Glass-Steagall at your confirmation hearing. And now you’ve just said the opposite. In the past few months, you and the president have had a number of meetings with big-bank C.E.O.s and lobbyists—is that the reason for the reversal on Glass-Stegall?

Steven Mnuchin: Not at all; there actually wasn’t a reversal.

Elizabeth Warren:There wasn’t a reversal?

Steven Mnuchin: Let me explain.

Elizabeth Warren: I’m ready.

Steven Mnuchin: The Republican platform did have Glass-Stegall. . . . The president said we do support a 21st-century Glass-Steagall, that means there are aspects of it that we think may make sense. But we never said before we support a full separation of banks and investment banking.

Elizabeth Warren:Let me just stop you right there, Mr. Secretary—

Steven Mnuchin: You’re not letting me finish—

Elizabeth Warren: Yeah, I'm not, because I really need to understand what you’ve just said. There are aspects of Glass-Steagall that you support, but not breaking up the banks and separating commercial banking from investment banking? What do you think Glass-Stegall was if that's not right at the heart of it?

Steven Mnuchin: Again, I’m well aware of what Glass-Steagall was, as you may know the original concern of Glass-Steagall was about conflicts not about credit risk, and if we had supported a full Glass-Stegall we would have said at the time we believed in Glass-Stegall, not a 21st-century Glass-Stegall. We were very clear in differentiating it.

Elizabeth Warren: I still haven’t heard the answer to my question; what do you think Glass-Stegall was if not separating commercial banking from investment banking, from ordinary banking?

Steven Mnuchin: Again, the fundamental part of Glass-Stegall was, as you just outlined, it was separation of investment banking from commercial banking because people were concerned about conflicts.

Elizabeth Warren: And how do you separate without breaking up the big banks that have integrated these two things?

Steven Mnuchin: Again, the integration of commercial banking and investment banking has gone on for a long time, that’s not what caused the financial crisis, and if we did go back to a full separation, you would have an enormous impact on liquidity and lending.

Elizabeth Warren: So let me get this straight. You’re saying you’re in favor of Glass-Steagall, which breaks apart the two arms of the banks, except you don’t want to break apart the two parts of banking. This is like something straight out of George Orwell. You’re saying simultaneously you’re in favor of breaking up the banks— that’s what Glass-Steagall is—

Steven Mnuchin: I never said we were in favor of breaking up the banks. If we had been, it would have been very simple .

Elizabeth Warren: Let me try one more time—what does it mean to be in favor of 21st-century Glass-Steagall if it does not mean breaking apart these two functions in banking?

Steven Mnuchin: I’d be more than happy to come see you and follow up—

Elizabeth Warren: Just tell me what it means. Tell me what 21st-century Glass-Steagall means if it doesn’t mean breaking up those two parts. It’s an easy question.

Steven Mnuchin: It’s actually a complicated question—

Elizabeth Warren: I’ll bet.

Steven Mnuchin: There are many aspects of it. The simple answer is we don’t support breaking up commercial and investment banks. We think that would be a huge mistake, but, again, I’m more than happy to listen to your ideas on it, you obviously have strong views.

Elizabeth Warren: This is just bizarre. The idea that you can say we’re in favor of Glass-Steagall but not in breaking up the banks.

Steven Mnuchin: We never said we were in favor of Glass-Steagall, we said we were in favor of a 21st-century Glass-Steagall. We couldn’t be clearer.

Elizabeth Warren: Thank you . . . this is crazy.

[For additional take on this exchange, click on Best Levin's column, "'This Is Crazy',,, ."]