BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

Wall Street’s 12 Most Salacious Scandals

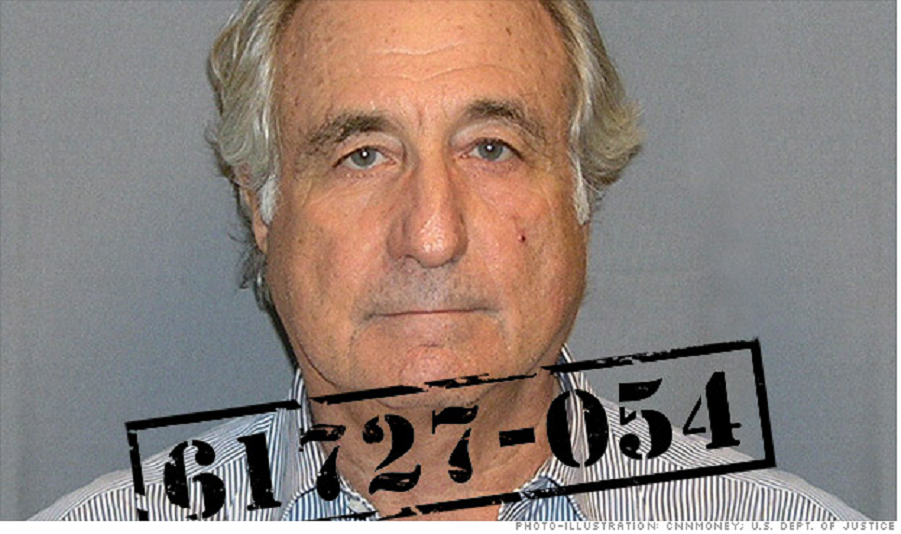

[Photo: Bernie Madoff, CNN Money, Dept of Justice]

Here's what landed the real Wolves of Wall Street behind bars, according to Vanity Fair.

MARTHA STEWART - The domestic doyenne, known primarily for teaching a whole class of homemakers the virtues of a perfectly-timed soufflé or a perfectly-folded sheet, imperfectly found herself in the Big House for five months in 2004, after she was convicted for conspiracy and obstruction of justice related to selling shares of drugmaker ImClone Systems.

MARTIN SHKRELI - The so-called “pharma-bro” created a national media frenzy when he hiked the price of a lifesaving drug by 5,000 percent overnight in 2015, and continued to fan the flames by buying a $2 million single-copy Wu-Tang Clan album and picking fights with presidential candidates. In the midst of the firestorm, he also got arrested and charged with 8 counts of fraud after prosecutors accusing him of using a public drug company he ran as a personal piggybank to pay back investors whose money he lost at his now-defunct hedge funds.

BERNIE MADOFF - The name Bernie Madoff has become synonymous with reprehensible greed after the Wall Street fraudster was caught stealing his victims’ fortunes to live like a king. Madoff was sentenced to 150 years in prison—the maximum for his crimes—after pleading guilty to 11 counts of myriad financial crimes related to a Ponzi scheme that swallowed up $10 billion of investors’ money.

Click link below for the rest:

ALLEN STANFORD

STEVE COHEN

RAJ RAJARATNAM

MICHAEL MILKEN

JEFFREY SKILLING

R. FOSTER WINANS

MATHEW MARTOMA

SAGE KELLY

BRUNO IKSIL