BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

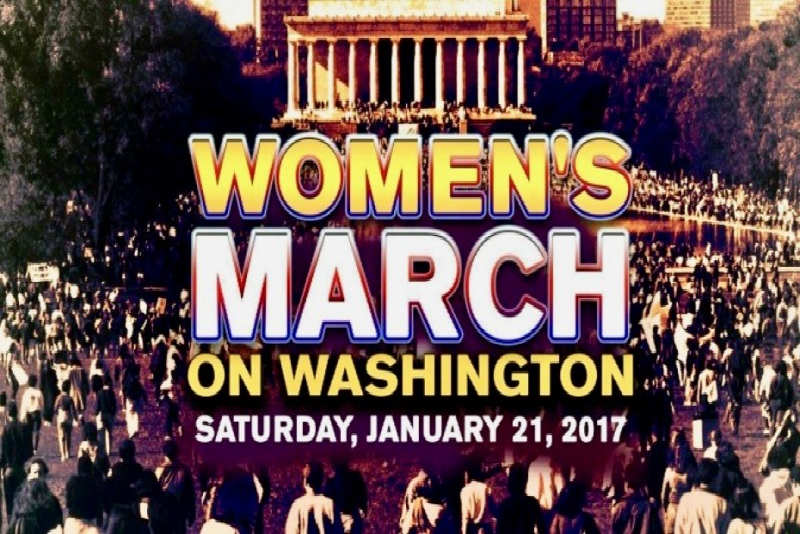

Wall Street Women Mobilize for Women’s March in Washington

Hillary Ripley, Alexandra Lebenthal and Jodi Schwartz all have something in common. Each is rising to the call to protest the incoming administration of President-elect Donald Trump and to speak up for gender equality.

Hillary Ripley was on a stair climber ….. at her Brooklyn gym when her 16-year-old daughter texted. A women’s march was being organized in Washington, the teenager wrote, to protest the incoming administration of President-elect Donald Trump and to speak up for gender equality. Ms. Ripley hopped off the machine and began searching for a bus-charter company.

- “I think about markets,” said Ms. Ripley, a longtime investor-relations professional who has worked in both banks and private equity firms. “It occurred to me immediately that there was going to be a tremendous demand for buses.”

- She contacted US Coachways, got a quote for a 55-seat bus ($3,050 for a day trip) and began querying neighborhood friends to gauge whether she could recruit enough would-be marchers to break even. The seats quickly filled.

Alexandra Lebenthal, CEO of a stock and bond broker .…, from her home on the Upper East Side of Manhattan, was also making plans to travel to Washington.

- “I never have done anything like this in my life before, and I just feel like it’s a time when everybody has to stand up for what they believe in,” Ms. Lebenthal, who was a Hillary Clinton supporter, said.

- It is an unusual stance for a woman working in the cutthroat world of finance. Wall Street women — though often tough, tenacious and outspoken — are not a crowd accustomed to street protest.

Jodi Schwartz, a corporate tax lawyer, …. at Wachtell, Lipton, Rosen & Katz, a firm in Midtown Manhattan known for providing M&A advice, noted, “I’m not a frequent demonstration participant.”

- Making time within a cramped schedule to attend the protest rather than taking the simpler route of writing a check to support the cause, Ms. Schwartz said, took some effort. But, she added, “as soon as I heard about this, I knew I was going to go because of my level of horror at the way folks are talking about women’s issues postelection.”

- Ms. Schwartz cited a post she had seen on social media stating that 56 new legislative measures curbing women’s access to abortion had recently been announced.

The inauguration of Mr. Trump has prompted a striking number of Wall Street women to overcome their worries about demonstrating in public. Based on interviews with numerous women from banks, hedge funds, other asset managers, financial law practices and private equity firms, it appears that dozens of industry women in New York, and perhaps significantly more, intend to make the trek to Washington to participate in the march on Saturday.

Some managers at private equity firms and banks said they were torn between urging would-be marchers to take caution to avoid angering Trump supporters in the client base and encouraging free expression, regardless of the professional consequences.

Ms. Lebenthal, who runs one of the largest woman-owned brokerages on Wall Street, said she was unmoved by client concerns. “I have friends that voted for Trump,” she said. “I have a major issue with that, but it’s their right. And I wouldn’t stop doing business with that person if they voted for Trump.”

As for clients who reconsider doing business with Ms. Lebenthal because of her involvement in the women’s march, she said, “If that happens, it happens.”