BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

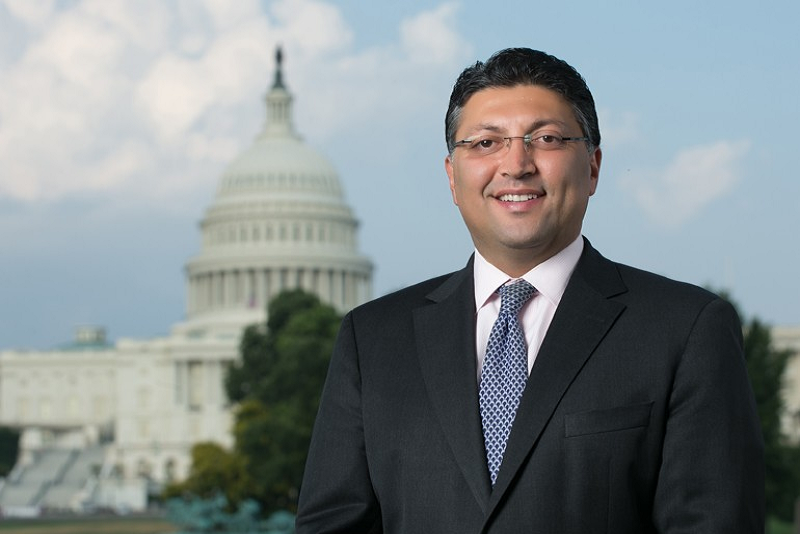

Wall Street Deal Makers Have Vested Interest in Trump's Antitrust Nominee

President Trump on Monday nominated Makan Delrahim to lead the Justice Department’s Antitrust Division, which reviews mergers and acquisitions. Mr. Delrahim’s appointment must first be confirmed by the Senate. Since January, Mr. Delrahim has been serving as Deputy Counsel to the President, a position that, among other things, had him helping to steer Judge Neil Gorsuch through his Supreme Court nomination.

As Chief of the Antitrust Division, Delrahim would review corporate mergers at a time when many investors and corporate executives are anticipating a more relaxed view of deal-making after years of tough oversight by the administration of former President Barack Obama. That’s a position for which he’s qualified. Here’s his career track, according to his profile on LinkedIn:

- The White House: Deputy Counsel to the President, Nominations & Oversight; Jan 2017 – Present

- Brownstein Hyatt Farber Schreck: Partner/Lobbyist; Aug 2005 – Jan 2017

- Pepperdine University: Adjunct Professor of Law; 2011 – Jan 2016

- Antitrust Modernization Commission: Commissioner; 2003 – 2007

- U.S. Department of Justice: Deputy Assistant Attorney General; Jul 2003 – Aug 2005

- Senate Judiciary Committee: Chief Counsel / Chief of Staff; 2000 – 2003

- Patton Boggs LLP: Associate; 1995 – 1998

- Education: JD from George Washington Law; MS from Johns Hopkins; BS from UCLA.

During his 2 years at the Justice Department - 2003 to 2005 - Delrahim worked for Hewitt Pate, who was assistant attorney general of antitrust. Under Pate, the division was criticized for allowing too many deals, though it did step up to oppose several deals, including the merger of U.S. Airways with United Airlines. As Pate's deputy, Delrahim specialized in international antitrust.

Presuming he’ll be confirmed, Mr. Delrahim will start out with a full slate of deals to consider – not the least of which is AT&T’s $85 billion bid for Time Warner. During his campaign, President Trump said repeatedly that he would block that deal – in part because he doesn’t like CNN News, which is owned by Time Warner. That said, Mr. Delrahim has said he doesn’t see major problems with that merger .

THE BOTTOM LINE. What all this amounts to is greater expectation of a free-market approach to antitrust regulation. And that will impact Wall Street’s bottom line – which should nicely complement the trading boon that Wall Street firms have been enjoying since election day. And with renewed volatility in the market, the Street has been blessed with ample opportunities for trading gains.