BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

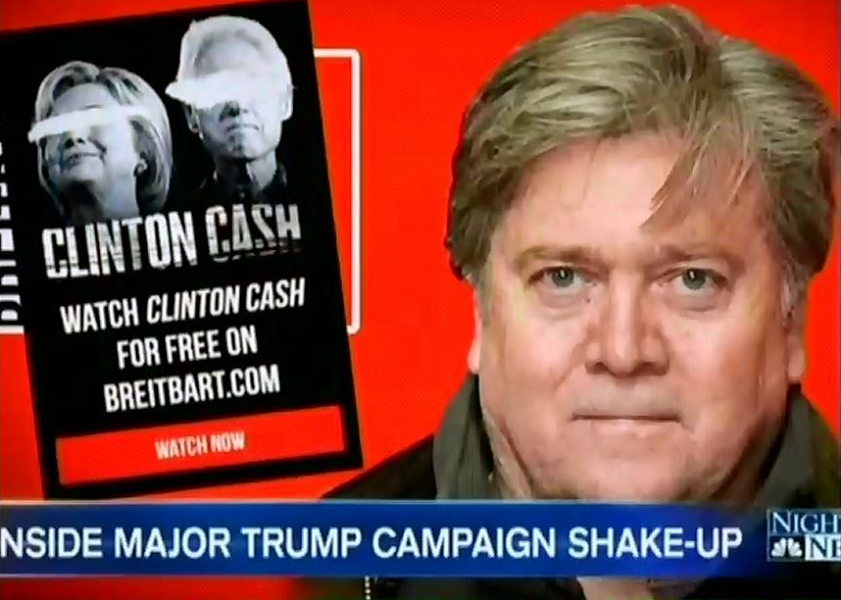

Steve Bannon Could Be Wall Street's Worst Enemy

[Photo: Media Matters for America]

Beware Steve Bannon, chief strategist for Donald Trump's administration. Even though he 'cut his teeth' as an investment banker with Goldman Sachs, he's got a sharp tongue on Wall Street practices and believes the financial industry has been a wee bit coddled.

[ By the way, for those who don't know him, Stephen Bannon is Executive Chairman of Breitbart News, an organization that caters to the extreme views of the ‘Alt-Right.’ During the campaign he served as Trump’s Chief Strategist as he will continue to do for the Trump Presidency. ]

Take for example Bannon’s presentation during a 2014 conference at the Vatican, in which he ripped into big banks and their role in the 2008 financial crisis. He rued that no one ever was held accountable, which he said helped fuel populist fury and groups like the tea party. On the subject of bailouts, he added:

For Christians, and particularly for those who believe in the underpinnings of the Judeo-Christian West, I don't believe that we should have a bailout. I think the bailouts in 2008 were wrong. And I think, you look in hindsight, it was a lot of misinformation that was presented about the bailouts of the banks in the West.

At the conference, Bannon was asked about poverty and proceeded to riff on the role banks played:

The 2008 crisis, I think the financial crisis - which, by the way, I don't think we've come through - is really driven I believe by the greed, much of it driven by the greed of the investment banks. My old firm, Goldman Sachs - traditionally the best banks are leveraged 8:1. When we had the financial crisis in 2008, the investment banks were leveraged 35:1.

After diagnosing the conditions that led to the crisis, he talked about the fallout, or lack thereof, for the financial engineers who helped drive up risk and create the Great Recession but never really had to pay the price:

Particularly the fact - think about it - not one criminal charge has ever been brought to any bank executive associated with 2008 crisis. And in fact, it gets worse. No bonuses and none of their equity was taken. So part of the prime drivers of the wealth that they took in the 15 years leading up to the crisis was not hit at all, and I think that's one of the fuels of this populist revolt that we're seeing as the tea party. So I think there are many, many measures, particularly about getting the banks on better footing, making them address all the liquid assets they have. I think you need a real cleanup of the banks balance sheets.

Bannon advocated breaking up the financial supermarkets during his Vatican speech:

In addition, I think you really need to go back and make banks do what they do: Commercial banks lend money, and investment banks invest in entrepreneurs and to get away from this trading - you know, the hedge fund securitization, which they've all become basically trading operations and securitizations and not put capital back and really grow businesses and to grow the economy.

Big bankers and hedge funds, he said, "have never really been held accountable for what they did [and that] has fueled much of the anger in the tea party movement in the United States."