BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

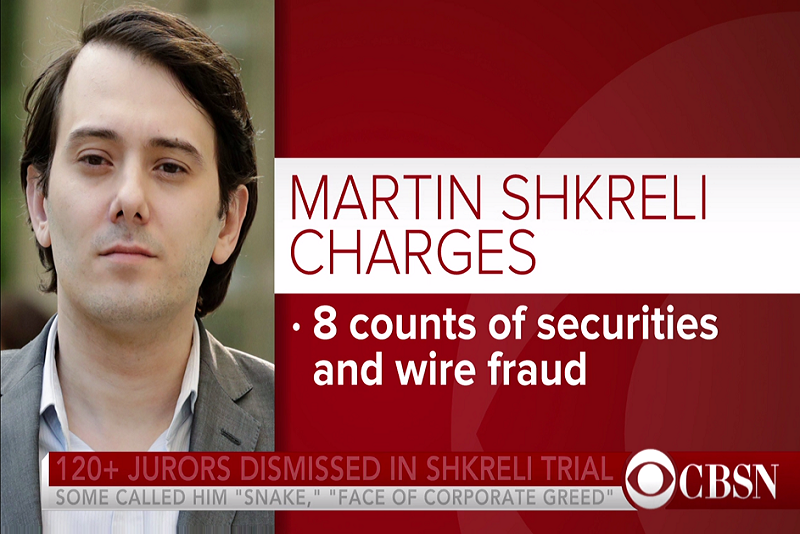

'Pharma Bro' Martin Shkreli Guilty of Securities Fraud

[Photo: Screen Grab from CBS News]

A federal jury found Martin Shkreli - aka 'Pharm Bro' - guilty on 3 counts of securities fraud, but acquitted him on 5 other counts. He faces up to 20 years in prison on the most serious charges, though he's likely to get much less.

Shkreli was charged with 8 separate counts of securities fraud, conspiracy to commit securities fraud and wire fraud, for his role managing a pair of hedge funds - MSMB Capital Management and MSMB Healthcare - between 2009 and 2014.

The government had accused Shkreli of defrauding investors and lying about the funds' performance, and that he later stole more than $11 million from Retrophin, a company he founded and brought public, to pay back those investors. However, the case was tricky for prosecutors because investors, some wealthy financiers from Texas, condeded at the trial that Shkreli's scheme actually made them richer, in some cases doubling or even tripling their money on his company's stock when it went public. The defense portrayed them as spoiled "rich people" who were the ones doing the manipulating.

"Who lost anything? Nobody," defense attorney Brafman said in his closing argument. Some investors had to admit on the witness stand that partnering with Shkreli was "the greatest investment I've ever made," he added.

Federal prosecutors responded: “Just because the defendant got lucky and Retrophin became a success years later” that doesn’t excuse fraud. “Martin Shkreli doesn’t think the rules doesn’t apply to him, that the law doesn’t apply to him unfortunately for him, it does.”

Shkreli and his lawyer, Ben Brafman, were thrilled by the verdict. "We think verdict as it now stands, will permit this court to impose very lenient sentence," Brafman said - which Shkreli interpreted to mean that he may serve only a couple of months in "Club Fed."