BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

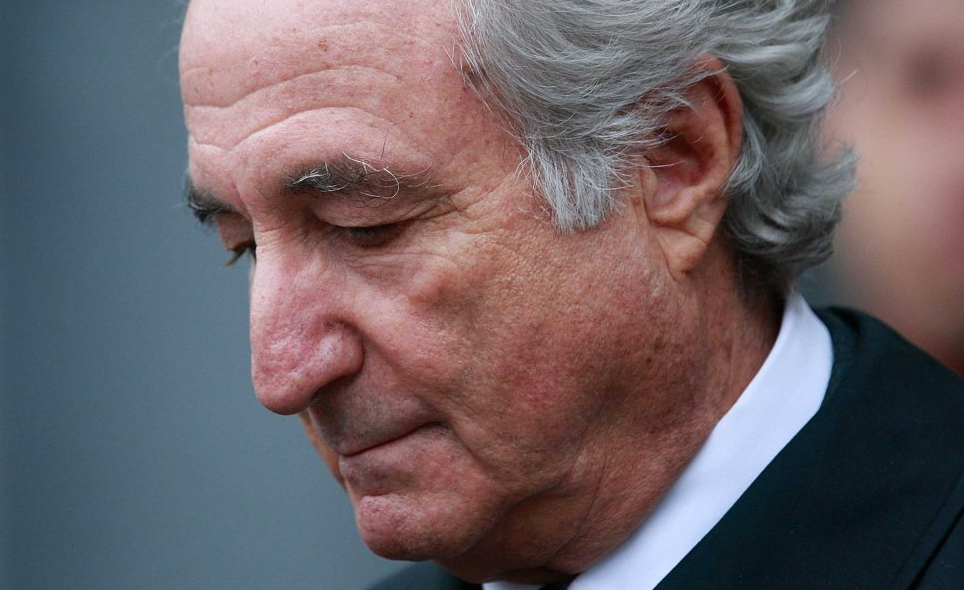

Never-Before-Heard Bernie Madoff Tapes - His Details of Ponzi Scheme

Banks and wealthy investors are to blame for Bernie Madoff’s Ponzi scheme, according to a series of never-before-heard recordings released by author Steve Fishman. They just didn’t care whether his firm, Bernard L Madoff Investment Securities, was legitimate or not.

The new audio series, Ponzi Supernova, compiled by author Fishman from interviews he had with the depraved Ponzi criminal, features much of Madoff’s characteristic refusal to take responsibility for paying his investors out of each other’s pockets.

Bernie promised steady and sizable returns from canny investments, but in reality paid investors with other investors’ cash. As the firm became increasingly “successful” Madoff said the banks that at first shunned him were suddenly beating down his door:

“All of a sudden these banks give you the time of day. They’re willing to give you a billion dollars. I had all of these major banks coming down and entertaining me. It is a head trip.”

Fishman, who personally conducted 3 hours of interviews with Madoff, points out that while the fraudster ruined many lives, roughly half of Madoff’s investors still ended up in the black. According to Fishman:

“What really makes him a pandemic is all the feeder funds [who introduced new clients to Madoff] and the banks.” “They take him around the world. They recruit investors, in Latin America and through Europe, and they basically pour gasoline on this dumpster fire. Madoff could have been kind of a local swindler until he meets this massive distribution network.”

The forgeries committed on some clients’ documents, Fishman said, were even done as if to order by some clients. According to ex-FBI agent Steve Garfinkel, Annette Bongiorno, Madoff’s longtime assistant and first employee, would doctor statements on request. Clients would call to complain that Madoff promised 18% but they’d gotten 16%. Bongiorno would respond with an amended statement showing the promised rate. Bongiorno began her own sentence of six years for her role in the scheme in 2014.

Madoff also said the scheme lasted as long as it did because the inexperienced SEC regulators chasing him didn’t know what they were looking for, and because his operation stayed one step ahead of the regulator. In one anecdote, Madoff simply rifles through an inspector’s briefcase until he finds that he’s being pursued for “front-running.” That seemed logical, Madoff admits, “except it wasn’t true, and it was illegal!”

Madoff further postured with the regulators who visited his offices in search of evidence of wrongdoing. When an investigator asked to see a report that a legitimate firm would have on hand in the course of its normal businesses, Madoff’s second-in-command, Frank DiPascali, stalled for time while downstairs others printed out a faked report, put it in the refrigerator so it wouldn’t be obviously warm from the printer, and “played football with it”, tossing it back and forth across the room like a football to make it look weathered.