BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

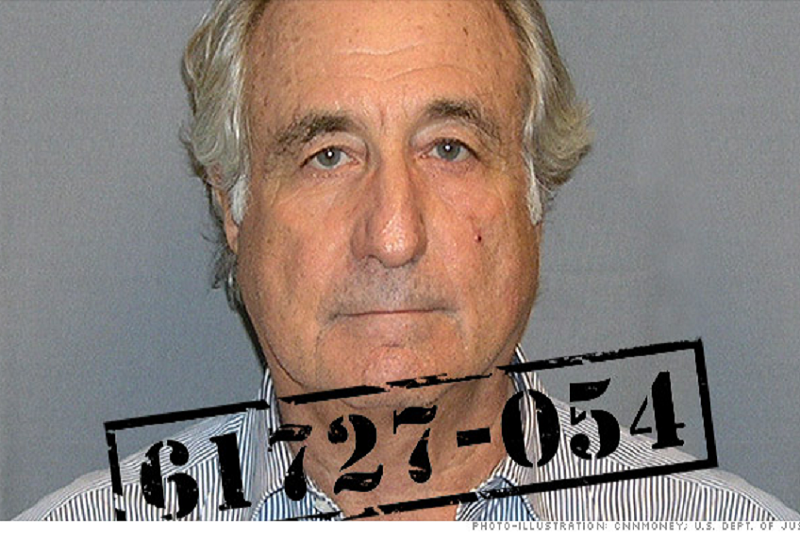

Madoff Ponzi Scandal - 10 Year Anniversary

Here's how some of the press recalled Bernie Madoff's $65 billion ponzi scheme - 10 years after his arrest on December 11, 2008.

Bernie Madoff's Ponzi scheme 10 years later: Watch CNBC's 2008 coverage [CNBC]

► As details were revealed of Bernie Madoff's Ponzi scheme in December 2008, CNBC covered the breaking news, the court proceedings and spoke with the victims of his lies.

► Believe it or not, Bernie Madoff's phony monthly trading reports listed trades on days the market was closed, or at prices that were far off the market, or in volumes that simply never existed.

► Yet Madoff's scam continued for 36 years, from 1972 until 2008, as the SEC was incapable of discovering the truth, and Madoff's clients never read their phony monthly statements, since through bull and bear markets Madoff always turned in profits that were not real.

► Ten years after the epic Madoff scam blew up, thousands of people are still picking up the pieces.

► Some victims have fared better than others, sparking a still-raging debate about investor protections.

► Victims say the Madoff scandal offers some important lessons for all investors.

Is the next Madoff lurking on the horizon? Experts will not rule it out. [CNBC]

► Ten years after Bernie Madoff’s $65 billion fraud shocked the world, experts worry that renewed market volatility could reveal the next big scam.

► The Madoff scandal exposed gaping weaknesses in financial regulation. The resulting reforms are now being put to the test.

► Could a Madoff-size scandal happen again? Experts will not rule it out.

Madoff Fraud Ushered In Changes to Secretive Hedge Fund Industry [Bloomberg]

► Middle men endured 10 straight years of asset declines

► Funds became less secretive and investor scrutiny increased

10 Years Later: What Can We Learn From Madoff's Downfall? [Forbes]

► His now-infamous Ponzi scheme rattled markets and cultural spheres when he financially crippled many well-known individuals, nonprofits and large pension funds.

► In many ways, Madoff highlighted all that was wrong with Wall Street: investors pursuing profits over all else, a reliance on exclusivity, walled gardens and not nearly enough scrutiny by investors despite countless red flags.