BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

How Blockchain Will Affect Financial Services Employment

Every so often, a new technological development comes along which revolutionizes the financial services industry. Not since the introduction of the internet – more than 2 decades ago – has any force promised to shake-up the industry with as much force as blockchain. The same technology behind Bitcoin, blockchain is now finding new applications in financial services.

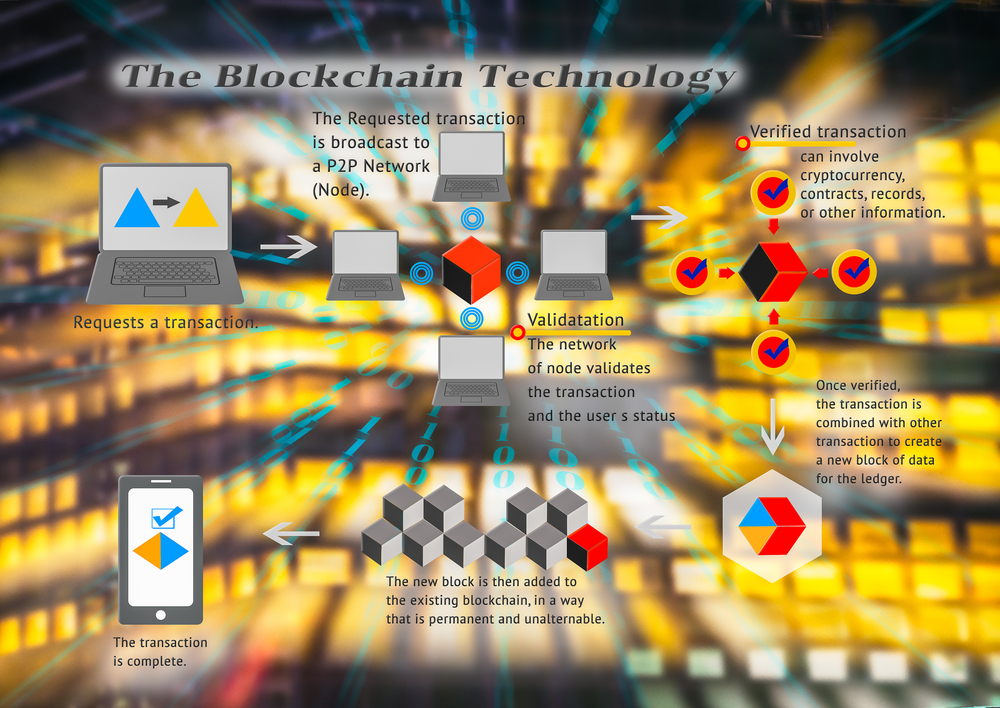

Blockchain can be thought of as essentially a digital ledger. Much like Google Sheets, the blockchain itself is a basic spreadsheet hosted from every user’s computer. The distributed ledger simply records transactions, then shares that information in a constantly-updated database that is freely viewable by all users. It can be accessed, traced and verified against itself at any time by anyone with the software, thereby enforcing accountability and making fraudulent transactions much more difficult to perpetrate.

BLOCKCHAIN’S POTENTIAL IMPACT FINANCIAL SERVICES EMPLOYMENT. A technology as revolutionary as blockchain will undoubtedly have a major impact on the financial services landscape. Many herald blockchain for its potential to demystify the complex financial services industry, while also reducing costs, improving transparency to reduce the regulatory burden on the industry. But with adoption of blockchain technology, would the cons (costs) outweigh the pros (rewards)?

Blockchain will cut headcount for some professions, but create other jobs. Financial firms will be able to cut a tremendous sum in operational costs, and that would mean cutting jobs, as well. Case in point: blockchain transactions require very little oversight in the way of processing reconciling; thus, jobs in these fields will not be relevant with wider adoption of the technology. However, new roles in security fields will arise - like encryption and identity protection - as financial services firms will still need to audit their records against blockchain to detect potential fraud or other threat sources.

Blockchain, if used properly, promises to deliver benefits to consumers, governments, banks and other financial institutions. By the same token, those who may stand to be displaced by blockchain need not fear being tossed out on the street next week. Though the blockchain concept has grown a great deal since it was used in the first Bitcoin exchange in 2009, it will be several years before we should expect any kind of widespread application.