BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

Goldman & Other Banks Moved Thousands of Jobs Out of the U.S.- Will Trump Go After Them, Too?

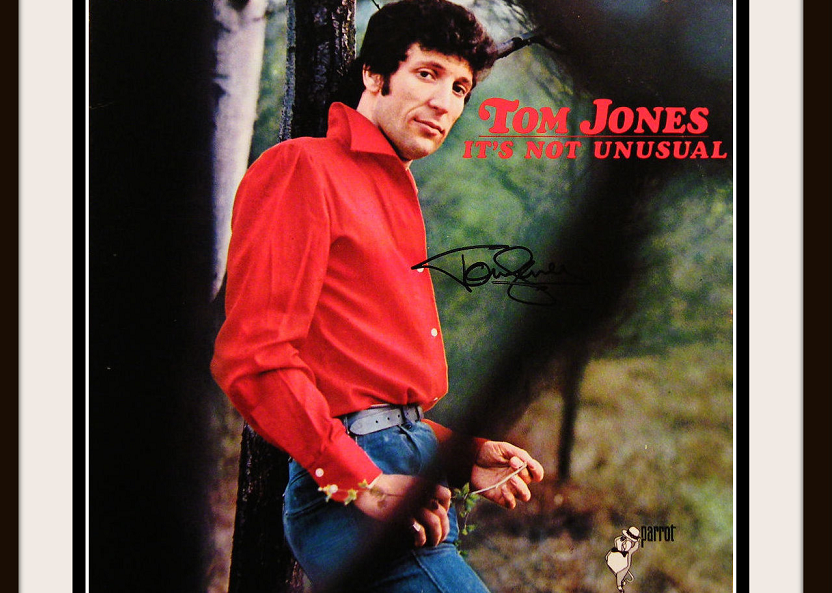

'It's Not Unusual' - by Tom Jones

Goldman Sachs’ biggest office outside its New York City headquarters isn’t in the financial centers of London or Hong Kong - it is in the sprawling south Indian city of Bangalore, now officially called Bengaluru.

At the “Embassy Golf Links Business Park,” a neatly laid out campus with palm trees and fountains, nearly 6,000 Goldman Sachs employees do support and service work for the bank’s global operations, taking care of everything from banker payroll and IT to preliminary research for its analyst reports.

Goldman has grown sharply in India under Gary Cohn, the bank’s president who is reportedly being considered for a position in the Treasury, Federal Reserve, or Office of Management and Budget. As president of the bank for the past decade, Cohn regularly touted the benefits of moving jobs from financial centers like New York to lower cost areas like Bengaluru or Singapore, as well as Salt Lake City and Dallas.

IT'S NOT UNUSUAL. Goldman’s actions aren’t that unusual - since the early 2000s, U.S. companies have moved several million white-collar jobs, from payroll to legal research to coding, to areas far from home, often in Eastern Europe and India. Surprisingly, as Trump makes punishing companies that send U.S. jobs overseas a key focus of the new administration, the offshoring of service-sector jobs has been absent from the discussion.

IT'S NOT UNUSUAL. Goldman’s actions aren’t that unusual - since the early 2000s, U.S. companies have moved several million white-collar jobs, from payroll to legal research to coding, to areas far from home, often in Eastern Europe and India. Surprisingly, as Trump makes punishing companies that send U.S. jobs overseas a key focus of the new administration, the offshoring of service-sector jobs has been absent from the discussion.

Trump’s ties to Goldman Sachs, meanwhile (former Goldman partner Steven Mnuchin is Trump’s pick for treasury secretary, and another former Goldman banker is a key advisor), helped push the bank’s stock to highs not seen since before the financial crisis after his election. In fact, many of the U.S.’s biggest banks who embraced moving jobs to low-cost areas have had huge stock rallies ahead of Trump’s swearing-in.

GOLDMAN’S “HIGH VALUE LOCATIONS”. Goldman Sachs was one of the pioneers of the offshoring process in the banking industry. The bank opened an office in Bangalore in 2004, to “provide critical support and service functions for Goldman Sachs around the world.”

In the early days on the Bangalore campus “we worked out of a temporary setup that had tin roofs,” said one member of the bank’s team in India who did not wish to be identified by name. Goldman CEO Lloyd Blankfein visited several times between 2006 and 2010, two former employees said.

The bank’s neighbors on campus include real-estate giant Cushman & Wakefield, IBM, Yahoo, and Microsoft – some 43,000 employees now work on that one campus alone. The Embassy Golf Links park is so renowned that it provides the opening scene for Thomas Friedman’s 2005 book that made outsourcing an international phenomenon, “The World Is Flat.”

As Wall Street cut costs after the financial crisis, banks shifted even more sophisticated jobs from financial headquarters like New York to locations in India, including statistical analysis, charting, and investment-banking research. These newly outsourced jobs were “middle office,” not back office ones, the type that would have been done by a freshly minted Wharton MBA in the US in the past.

[Click to continue reading.]