BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

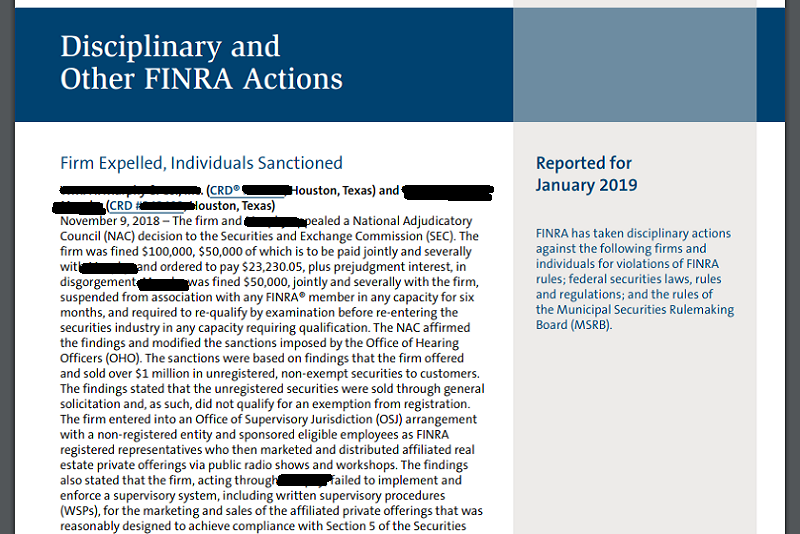

FINRA Reports Disciplinary Actions Against 8 Firms, 42 Individuals

In Disciplinary and Other FINRA Actions for January 2019, FINRA reported cases (AWC's) involving 8 member firms and 42 associated persons. FINRA also reported complaints against 2 firms and 7 individuals. Financialish will analyze some of the closed or settled cases in upcoming posts.

FIRMS' CASES. In cases involving member firms, fines ranged up to $400K and restitutions ranged up to $890K. The largest cases involved: (i) sales of multi-class mutual funds or variable annuities; and, (ii) close outs of fails to deliver.

INDIVIDUALS' CASES. In cases involving individuals, fines ranged from $4K to $70K, disgorgements or restitutions ranged up to $125K, and suspensions ranged up to 18 months. Nine individuals were barred for refusing or failing to cooperate with FINRA investigations, while 14 individuals were barred for more egregious violative conduct.

Among the topics covered in cases involving individuals:

Converting Customer Funds: AWC #'s ... 016052434001; 2017055910201; 2018058953201.

Converting Firm Funds: AWC #s ... 2017054093801; 2016050741702; 2017055921701; 2016052411501.

Using Personal Email, Text Messaging: AWC #'s ... 2017052960801; 2017053436101.

Exercising Unauthorized Discretion: AWC #'s ... 2015043584402; 2017055321601; 2015044086401.