BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

FINRA Reports Disciplinary Actions Against 4 Firms, 40 Individuals

by Howard Haykin

In Disciplinary and Other FINRA Actions for April 2019, FINRA reported cases (AWC's) involving 4 member firms and 40 associated persons. FINRA also reported 5 complaints against individuals. Financialish will analyze some of the closed or settled cases in upcoming posts.

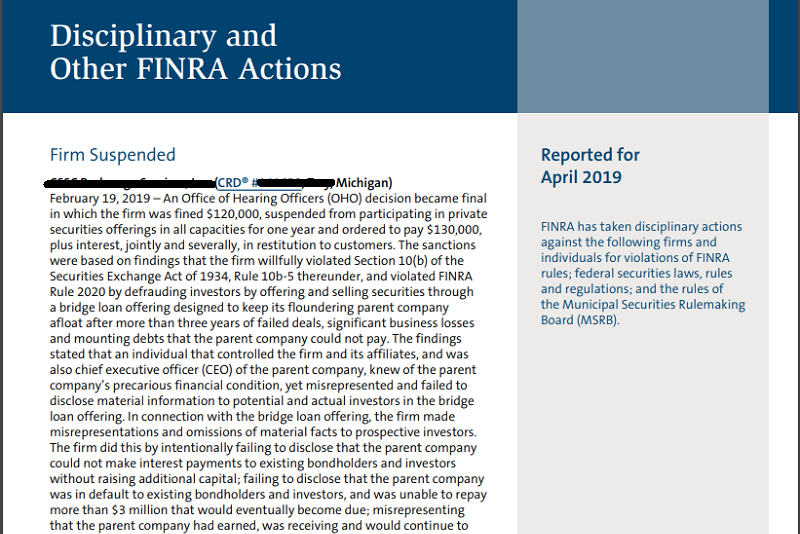

FIRMS' CASES. In cases involving member firms, fines ranged up to $225K and restitutions ranged up to $1.9 million.

- One firm was suspended from engaging in private securities offerings for one year.

- Another firm was barred from facilitating stock loans or block trading.

- The largest monetary sanctions involved sales of Mutual Funds.

INDIVIDUALS' CASES. In cases involving individuals, fines ranged from $5K to $73K, disgorgements or restitutions ranged up to $33K, and suspensions ranged from 15 days to 18 months. One individual was suspended from serving as a principal for 24 months.

- Twenty-one (21) individuals were barred, 8 of which for refusing / failing to cooperate with FINRA investigations.

- One individual was barred from ever serving in a principal or supervisory capacity.

Among the topics covered in cases involving individuals:

- Failure to Supervise: AWC #'s ... 2016048912703; 2013037522501; 2015047215401; 2015044823501; 2017052426601.

- Private Securities Transactions: AWC #'s ... 2018058504901; 2018057766401; 2018059666301; 2018058498401.