BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

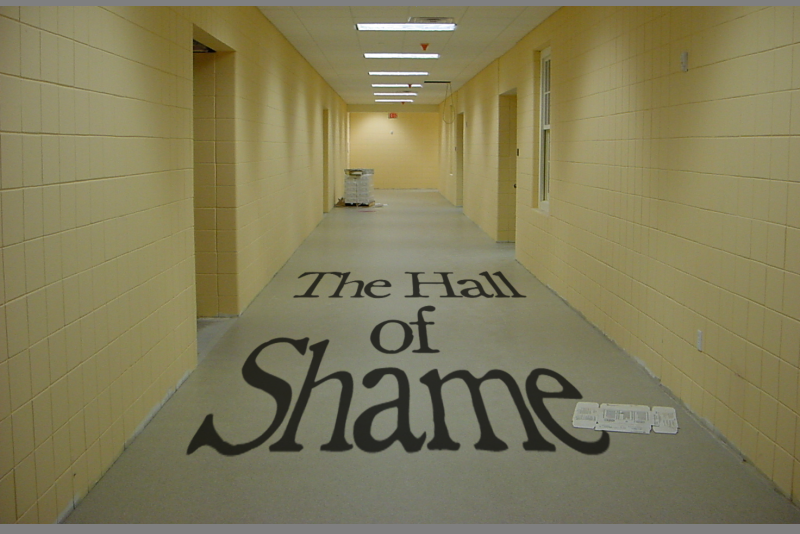

Financialish ‘Hall of Shame’ - Broker-Dealer Induction Ceremony

By Howard Haykin

Today, Financialish.com introduces its “HALL OF SHAME,” featuring broker-dealers that we believe were complicit in the abuse of elderly customers.

A broker-dealer is eligible for election to the Financial Hall of Fame if it satisfies the following criteria:

- One or more of the firm’s registered representatives were named in a settled compliant that appeared in a FINRA Monthly Disciplinary Actions report.

- The complaint(s) involved one or more elderly customers of the firm.

- Such customer(s) suffered significant financial losses.

- The financial abuse was carried out over a relatively prolonged period.

- The firm failed to take timely action so as to prevent or deter the financial abuse - even though firm principals were aware, or should have been aware, of the financial abuses, given that typical or basic supervisory reviews would have raised numerous ‘red flags’.

- The firm escaped FINRA sanctions for its so-called ‘complicity’.

In making its determinations, Financialish took into consideration relevant settlement documentation – ‘Orders Accepting Offer of Settlement’ or ‘Letters of Acceptance, Waiver and Consent’ (AWCs) – as well as applicable FINRA BrokerCheck records.

MAY 2017 INDUCTEES:

K.C. WARD FINANCIAL. Registered rep Broker Craig Dima was charged with unauthorized and unsuitable trades, including the numerous sales and buybacks of the customer’s long-term holdings in Colgate-Palmolive stock.

BAY MUTUAL FINANCIAL. Registered rep Christopher Ariola was charged with unsuitable recommendations, loading up customer accounts with high risk gold and energy stocks.

CAMBRIDGE INVESTMENT RESEARCH. Registered rep Curtis Randle El was charged with unsuitable recommendations from February through September 2014, effecting short-term trades in Class A mutual fund shares and Unit Investment Trusts (UITs).

WELLS FARGO ADVISORS. Registered rep Matthew Maczko, was charged with excessive trading in customer accounts from 2009 to 2016.

FINANCIAL WEST GROUP. Registered rep Kelly Althar was charges with high volume trading in customer accounts from 2011 to 2014.

STIFEL, NICOLAUS. Registered rep Harold Pomeranz was charged with unsuitable short-term trading of Unit Investment Trusts (UITs).