BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

DTCC Takes First Step Toward Adopting Blockchain Technology

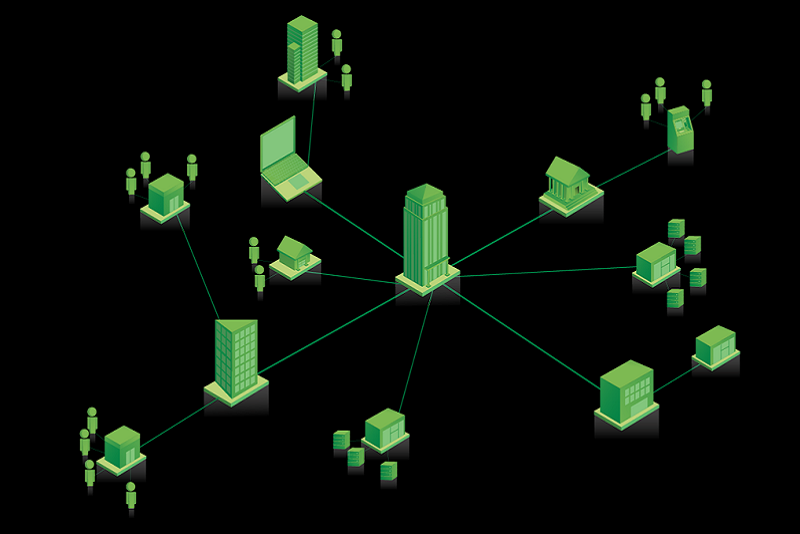

[Photo: Blockchain Distributed Ledger, by IBM]

It took months of talk and hype, but the world’s biggest banks have taken the first steps toward moving a significant piece of financial infrastructure onto a so-called blockchain - the technology introduced by Bitcoin.

The NYC-based Depository Trust and Clearing Corporation (DTCC) plays a role in recording and reporting nearly every stock and bond trade in the United States – as well as most valuable derivatives trades – announced Monday that it would replace one of its central databases with new software inspired by Bitcoin. IBM, which has been making a big push into blockchain technology, will be leading the project for DTCC and aims to have it fully functioning by early next year.

“This is a real tangible step into what could be a very different future for Wall Street.” - - DTCC CEO Michael Bodson.

The announcement is one of the most advanced steps yet in Wall Street’s continuing effort to harness the technological concepts underlying Bitcoin.

APPEAL, ADVANTAGES OF BLOCKCHAIN TECHNOLOGY. Financial institutions around the world have been fascinated by Bitcoin not because of the volatile virtual currency itself, but because it introduced a new way of executing and recording financial transactions without a central authority. All Bitcoin transactions take place on a global financial ledger known as a blockchain, which is maintained and updated by a network of thousands of computers around the world, similar to the way that Wikipedia is kept up by diffuse volunteers rather than by a single company.

Wall Street has been drawn to the blockchain concept because it allows information to be recorded in real time without the bottleneck that central authorities generally introduce. The decentralized nature of the technology also makes it harder for attackers, or hackers, to take control of the network.

The DTCC project will not use Bitcoin’s blockchain - instead it is building something similar to a blockchain, known as a distributed ledger, which multiple financial institutions can update and view at the same time. Unlike Bitcoin’s blockchain, the DTCC ledger will be open only to invited participants.

DTCC CEO Bodson said the basic promise of a distributed ledger is that it provides “one version of the truth that everyone shares and everyone utilizes.”

The new ledger will replace an existing database, known as the “Trade Information Warehouse,” that records information about every credit default swap trade that comes through the DTCC CDS’s, which played a major role in the 2008 financial crisis, are essentially bets on the success of bonds.