BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

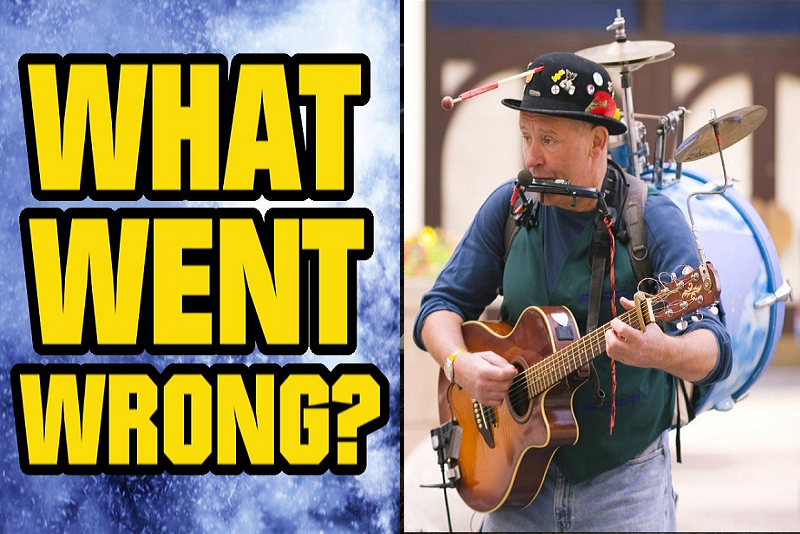

Broker Violated FINRA Suspension - Now He's Barred, His 'One Man Shop' Expelled

[Photo: One Man Band]

by Howard Haykin

Bruce Zipper was barred from the industry for continuing to conduct firm business while serving a 3-month suspension. Dakota Securities International, his firm, was expelled from FINRA membership for not adequately supervising Zipper, for allowing him to associate while suspended (and later while statutorily disqualified), and for falsifying books and records. Zipper has 45 days to appeal the decision.

FINRA FINDINGS. Zipper, a broker with 35 years’ experience with 14 firms, presently holds 5 licenses, including 3 supervisory/principal licenses: Series 4 (ROP), Series 24 (General Securities), and Series 27 (FinOp). Zipper founded Dakota Securities in 2005 and has associated with the firm ever since. He has served at various times as the firm’s President, CEO, CCO, and FinOp.

In April 2016, Zipper agreed to pay a $5K fine and serve a 3-month suspension (in all capacities) to settle FINRA charges that he failed to disclose 3 outstanding judgments on his Form U4. At the time, Zipper was a principal at a Dakota Securities, a small broker-dealer that operated as a “one man shop” where Zipper wore “all the hats.”

After agreeing to the settlement, Zipper notified FINRA that he was bringing another broker into his firm to conduct firm business during his suspension. Yet after his suspension started in May 2016, Zipper never stopped his association with Dakota. Among other things, …

- The broker brought in to replace Zipper conducted no meaningful supervision or oversight.

- Zipper regularly communicated with Dakota’s clearing firm and vendors regarding the firm’s ongoing operations.

- Zipper regularly communicated with Dakota customers in order to provide them with customers access to the firm’s website, their brokerage statements and other records, as well as Zipper’s investment analysis and recommendations that led to securities purchases.

- Zipper falsified Dakota’s books and records by misidentifying the broker of record in hundreds of trades.

- During the latter part of his suspension in August 2016, Zipper personally negotiated a settlement in an arbitration case against Dakota.

Zipper’s settlement resulted in his statutory disqualification. Under Article III, Section 3 of FINRA’s By-Laws, Zipper was required to reapply to FINRA for permission to continue his association with Dakota after the suspension. FINRA denied that permission because Zipper had violated the terms of his suspension, and because Dakota was incapable of exercising meaningful supervision over him. Even though FINRA’s decision denying permission to continue his association resulted in Zipper’s statutory disqualification, Zipper nevertheless continued to associate with Dakota.

Zipper by and large admits the Complaint’s allegations but asserts that Enforcement authorized much of his conduct. Zipper claims that an Enforcement attorney told him that if he “was the only person who could answer a question or solve a problem that might come up during his suspension … [Zipper] could intercede and resolve the problem so that the firm and a client would not be harmed.” Zipper also maintains that his misidentification of the responsible broker in hundreds of trades in firm records “was done with the full knowledge of all clients … and there was never a complaint either verbally or in writing from the firm’s clients.”

For details on this case, go to ... FINRA Disciplinary Actions Online, and refer to Case #2016047565702.