BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

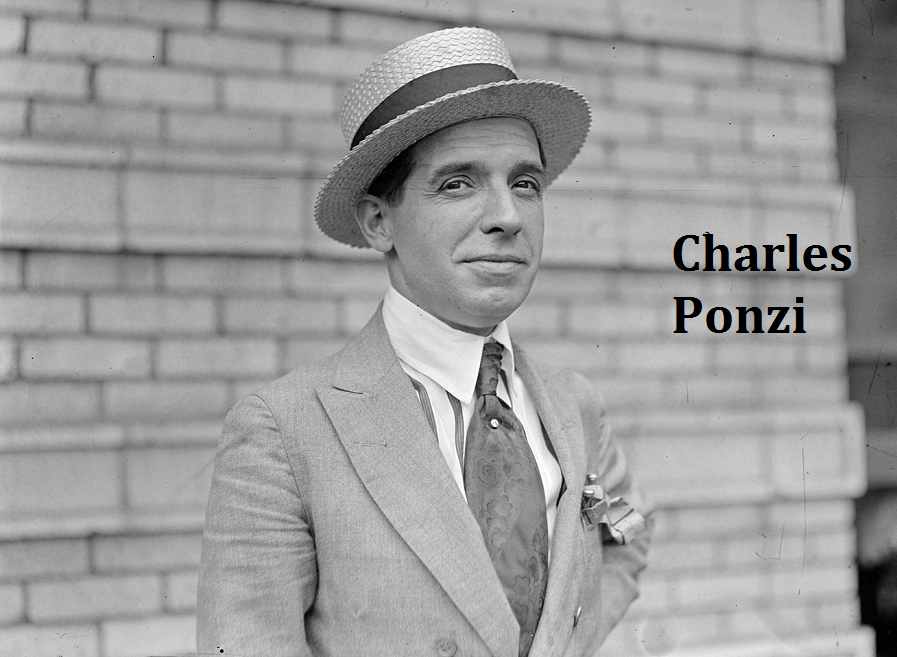

Broker Runs Ponzi Scheme Through Undisclosed Investment Partnership

Pennsylvania broker Paul Smith agreed to pay $363K in disgorgement and prejudgment interest to settle SEC civil charges that he operated a 25-year Ponzi scheme and investment advisory fraud.

BACKGROUND. Smith, a resident of Wayne, PA, has 34 years’ experience with 7 firms. A Series 7 general securities rep, Smith has been associated with Bolton Global Capital (2007-17), Philadelphia Brokerage Corp (2002-07), Tucker Anthony (2000-02), and Janney Montgomery (1990-2000). While he has no prior regulatory disclosures, Smith has over $500,000 in pending customer disputes.

SEC FINDINGS. In 1991, Smith began courting investors for The Haverford Group, a pooled investment partnership that he formed in 1990. Over time, he raised around $2.35 million from approximately 30 investors, including fellow country club members and longtime brokerage customers. Some were retirees or elderly individuals; most were generally unsophisticated.

Smith pitched The Haverford Group, for which he had sole discretion and trading authority, with the following purported investment strategy: “to participate in stock purchase and dividend reinvestment plans in which securities may be purchased directly from the issuer at a discount to their market value and simultaneously sold to capture the discount in the form of capital gain."

At no time did he disclose the existence of the partnership to any of the broker-dealers with which he was associated.

HAVERFORD AS A PONZI SCHEME. In the beginning, Smith made a few investments on behalf of Haverford. These limited investments aside, Smith principally used the invested funds to repay other investors and for his own personal use. All told, Smith wrote at least $247,000 worth of checks to himself from Haverford’s checking account.

To conceal his scheme, Smith …

- sent out fraudulent and fictitious quarterly account statements that indicated actual deposits and withdrawals, but also fictitious investment gains and account balances;

- mailed yearly income statements for tax purposes, showing investment gains broken down between taxable and non-taxable gains;

- funded investor withdrawals by raising money from new or existing investors, or by kicking in $196,000 of his own money to cover occasional shortfalls;

- kept his and Haverford's activities and accounts hidden from his associated broker-dealers.

In June 2011, Smith liquidated the brokerage account, and by October 2016 the Ponzi scheme collapsed when Smith was unable to return an investor’s $126,000 in principal plus purported investment gains. The investor then filed a complaint with her local police department, which contacted the SEC..

Eighteen investors were still invested in Haverford when Smith's scheme unraveled. Those 18 investors lost $886,000 of principal. Over the years, Smith wrote at least $247,000 worth of checks to himself from Haverford’s checking account. However, he put $196,000 back into Haverford’s checking account, for net payouts of $51,000.

SEC SETTLEMENT TERMS. Subject to court approval, Smith has agreed to pay disgorgement and prejudgment interest of $363,000, which would be deemed satisfied upon the entry of an order in a parallel criminal proceeding requiring Smith to pay a greater amount in restitution. Smith has agreed to plead guilty in the parallel criminal action.

[click for further details: SEC Complaint]