BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

Broker Accommodates Imposter Posing as the Customer

by Howard Haykin

A broker with Charles Schwab agreed to pay a $5K fine and serve a 90-day suspension to settle FINRA charges that “he made false statements to his member firm and caused it to maintain inaccurate books and records.” [In my opinion, ... the sanctions don’t match the ‘crime’ - FINRA should have used this case to send a message. However, no one asked for my opinion.]

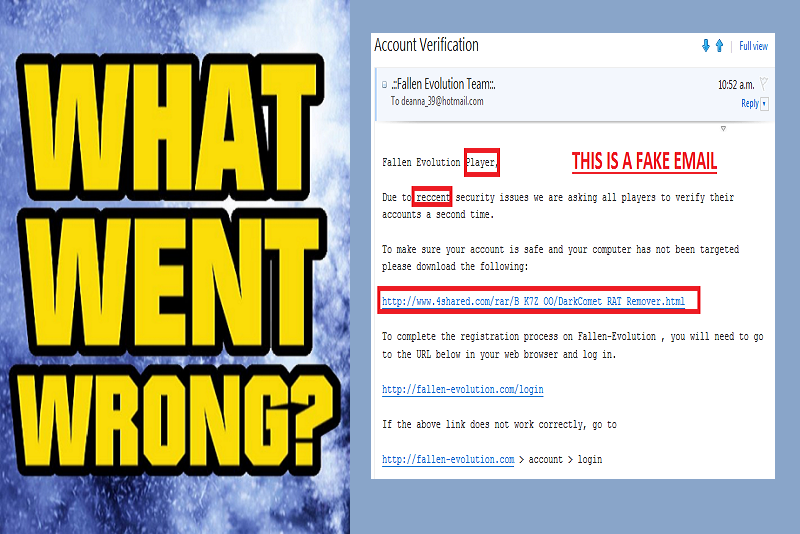

WHAT WENT WRONG. On 6 occasions during a 21-day span in August 2017, a broker received requests from a customer's email account to effect 8 wire transfers from the customer's Schwab account. Unbeknownst to the broker, the requests were made by an imposter who had gained access to the customer's email account.

On each occasion, the broker failed to follow Schwab's required Policies and Procedures, and/or failed to adequately respond to red flags:

- He failed to obtain verbal verification from the customer of a wire transfer request before processing the request.

- He did not verify the requests verbally even though the requests presented multiple red flags.

- Customer had not requested wire transfers of this type before, and there were multiple requests for wire transfers during a short period.

- Once, when a telephone call was scheduled, the imposter cancelled the call without explanation.

- While the customer had 8 accounts at Schwab, the emails did not specify which of the accounts should be used to obtain the wired funds.

- The recipient bank for one wire transfer raised questions about the purpose of the transaction before accepting the funds.

- For another wire transfer, the imposter provided incorrect routing information.

- The imposter requested that the broker refer to several wires as "personal loans" even though documents the imposter supplied to the broker purported to reflect that the wires were 'commission payments'.

And the broker proceed to lie numerous times to firm personnel and on firm documents so as to process the wire transfer requests:

- On 5 occasions, the broker falsely attested on a Schwab document that he had verbally verified the wire requests with the customer and had authenticated the customer's identity – and then submitted the form to a registered General Securities Sales Supervisor for approval.

- On the 6th occasion, when the broker couldn't locate a General Securities Sales Supervisor, he instructed another employee (who had recently joined Schwab) to falsely attest on the Schwab document that she had verbally verified the wire requests with the customer and authenticated the customer's identity - and then approved the document in his capacity as a General Securities Sales Supervisor.

- The broker provided false information to a Schwab Move Money Specialist who expressed concern about the frequency of the wire requests and who requested confirmation from Payne that he was not receiving the requests via email – the broker responded that the customer sent the requests via fax.

This case was reported in FINRA Disciplinary Actions for March 2019.

For further details, go to ... FINRA Disciplinary Actions Online, and refer to Case #2017055718001.