BROWSE BY TOPIC

- Bad Brokers

- Compliance Concepts

- Investor Protection

- Investments - Unsuitable

- Investments - Strategies

- Investments - Private

- Features/Scandals

- Companies

- Technology/Internet

- Rules & Regulations

- Crimes

- Investments

- Bad Advisors

- Boiler Rooms

- Hirings/Transitions

- Terminations/Cost Cutting

- Regulators

- Wall Street News

- General News

- Donald Trump & Co.

- Lawsuits/Arbitrations

- Regulatory Sanctions

- Big Banks

- People

TRENDING TAGS

Stories of Interest

- Sarah ten Siethoff is New Associate Director of SEC Investment Management Rulemaking Office

- Catherine Keating Appointed CEO of BNY Mellon Wealth Management

- Credit Suisse to Pay $47Mn to Resolve DOJ Asia Probe

- SEC Chair Clayton Goes 'Hat in Hand' Before Congress on 2019 Budget Request

- SEC's Opening Remarks to the Elder Justice Coordinating Council

- Massachusetts Jury Convicts CA Attorney of Securities Fraud

- Deutsche Bank Says 3 Senior Investment Bankers to Leave Firm

- World’s Biggest Hedge Fund Reportedly ‘Bearish On Financial Assets’

- SEC Fines Constant Contact, Popular Email Marketer, for Overstating Subscriber Numbers

- SocGen Agrees to Pay $1.3 Billion to End Libya, Libor Probes

- Cryptocurrency Exchange Bitfinex Briefly Halts Trading After Cyber Attack

- SEC Names Valerie Szczepanik Senior Advisor for Digital Assets and Innovation

- SEC Modernizes Delivery of Fund Reports, Seeks Public Feedback on Improving Fund Disclosure

- NYSE Says SEC Plan to Limit Exchange Rebates Would Hurt Investors

- Deutsche Bank faces another challenge with Fed stress test

- Former JPMorgan Broker Files racial discrimination suit against company

- $3.3Mn Winning Bid for Lunch with Warren Buffett

- Julie Erhardt is SEC's New Acting Chief Risk Officer

- Chyhe Becker is SEC's New Acting Chief Economist, Acting Director of Economic and Risk Analysis Division

- Getting a Handle on Virtual Currencies - FINRA

ABOUT FINANCIALISH

We seek to provide information, insights and direction that may enable the Financial Community to effectively and efficiently operate in a regulatory risk-free environment by curating content from all over the web.

Stay Informed with the latest fanancialish news.

SUBSCRIBE FOR

NEWSLETTERS & ALERTS

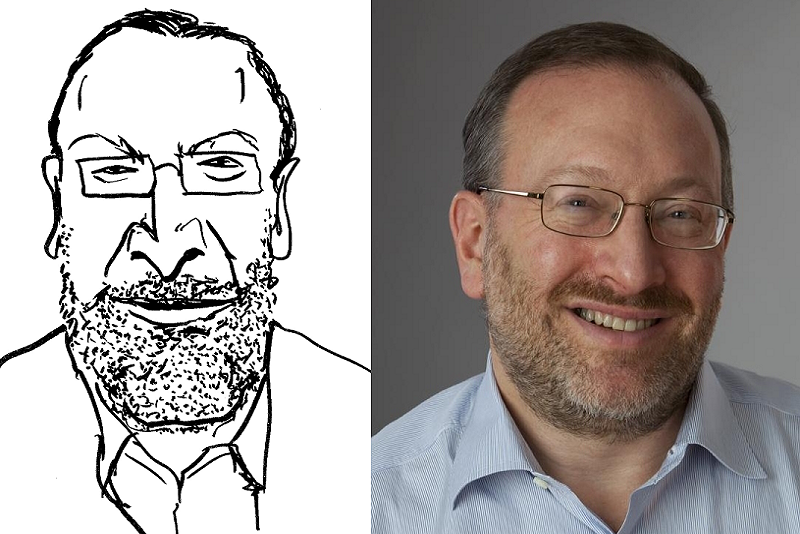

A Quiet Giant of Investing Weighs in on Trump

He is the most successful and influential investor you have probably never heard of. His writings are so coveted and followed by Wall Street that a used copy of a book he wrote several decades ago about investing starts at $795 on Amazon, and a new copy sells for as much as $3,500.

Perhaps that’s why a private letter he wrote to his investors a little over two weeks ago about investing during the age of President Trump — and offering his thoughts on the current state of the hedge fund industry - has quietly become the most sought-after reading material on Wall Street.

He is Seth A. Klarman, the 59-year-old value investor who runs Baupost Group, which manages some $30 billion.

While Mr. Klarman has long kept a low public profile, he is considered a giant within investment circles. He is often compared to Warren Buffett, and The Economist magazine once described him as “The Oracle of Boston,” where Baupost is based. For good measure, he is one of the very few hedge managers Mr. Buffett has publicly praised.

In his letter, Mr. Klarman sets forth a countervailing view to the euphoria that has buoyed the stock market since Mr. Trump took office, describing “perilously high valuations.”

“Exuberant investors have focused on the potential benefits of stimulative tax cuts, while mostly ignoring the risks from America-first protectionism and the erection of new trade barriers,” he wrote.

“President Trump may be able to temporarily hold off the sweep of automation and globalization by cajoling companies to keep jobs at home, but bolstering inefficient and uncompetitive enterprises is likely to only temporarily stave off market forces,” he continued. “While they might be popular, the reason the U.S. long ago abandoned protectionist trade policies is because they not only don’t work, they actually leave society worse off.”

In particular, Mr. Klarman appears to believe that investors have become hypnotized by all the talk of pro-growth policies, without considering the full ramifications. He worries, for example, that Mr. Trump’s stimulus efforts “could prove quite inflationary, which would likely shock investors.”

And he appears deeply concerned about a swelling national debt that he suggests could undermine the economy’s growth over the long term.

“The Trump tax cuts could drive government deficits considerably higher,” Mr. Klarman wrote. “The large 2001 Bush tax cuts, for example, fueled income inequality while triggering huge federal budget deficits. Rising interest rates alone would balloon the federal deficit, because interest payments on the massive outstanding government debt would skyrocket from today’s artificially low levels.”

Much of Mr. Klarman’s anxiety seems to emanate from Mr. Trump’s leadership style. He described it this way: “The erratic tendencies and overconfidence in his own wisdom and judgment that Donald Trump has demonstrated to date are inconsistent with strong leadership and sound decision-making.”

He also linked this point - which is a fair one - to what “Trump style” means for Mr. Klarman’s constituency and others.

“The big picture for investors is this: Trump is high volatility, and investors generally abhor volatility and shun uncertainty,” he wrote. “Not only is Trump shockingly unpredictable, he’s apparently deliberately so; he says it’s part of his plan.”

While Mr. Klarman clearly is hoping for the best, he warned, “If things go wrong, we could find ourselves at the beginning of a lengthy decline in dollar hegemony, a rapid rise in interest rates and inflation, and global angst.”

[Click link to continue reading.]